RESOLUTION

A RESOLUTION AMENDING A RESOLUTION

AUTHORIZING AND DIRECTING THE CALLING AND HOLDING OF A SPECIAL ELECTION IN TULSA COUNTY , OKLAHOMA, FOR THE PURPOSE OF SUBMITTING TO THE REGISTERED, QUALIFIED VOTERS

OF SAID COUNTY THE QUESTION OF LEVYING AND COLLECTING A FOUR-TENTHS OF ONE

PERCENT (4/10%) SALES TAX FOR THE PURPOSE OF ARKANSAS RIVER CORRIDOR DEVELOPMENT

WITHIN TULSA COUNTY, OKLAHOMA, AND/OR TO BE APPLIED OR PLEDGED TOWARD THE

PAYMENT OF PRINCIPAL AND INTEREST ON ANY INDEBTEDNESS, INCLUDING REFUNDING

INDEBTEDNESS, INCURRED BY OR ON BEHALF OF TULSA COUNTY FOR SUCH PURPOSE;

PROVIDING BALLOT TITLE; PROVIDING FOR NOTICE TO TULSA COUNTY ELECTION BOARD,

POLLING PLACES AND CONDUCT OF SUCH ELECTION; AND PROVIDING FOR COMMENCEMENT AND

DURATION OF SUCH SALES TAX.

WHEREAS, it is deemed

necessary and advisable by the Board of County Commissioners of Tulsa County,

Oklahoma, to improve the general economic conditions and quality of life of the

people of Tulsa County, Oklahoma, by development of the Arkansas River corridor

within the County; and

WHEREAS, there are no

funds in the treasury for such purpose and power is granted said County by

Title 68, Oklahoma Statutes 2001, Section 1370, as amended, to levy and collect

a sales tax to provide funds for such purpose providing the same be authorized

by a majority of the registered voters thereof voting at an election duly held

for such purpose; and

WHEREAS, the Board of County Commissioners of Tulsa County, Oklahoma, adopted a comprehensive resolution on August 2, 2007 (the “Original Resolution”),

calling an election for the foregoing purpose; and

WHEREAS, it has been determined to amend and restate the Original

Resolution in its entirety as hereinafter provided in order to clarify certain

aspects of the projects to be funded from such sales tax and the composition

and duties of the public trust created in connection therewith.

BE IT RESOLVED BY THE BOARD OF COUNTY COMMISSIONERS OF TULSA COUNTY, OKLAHOMA:

Section 1.The Original Resolution is hereby amended in its

entirety to read as follows:

“RESOLUTION

A RESOLUTION AUTHORIZING AND DIRECTING

THE CALLING AND HOLDING OF A SPECIAL ELECTION IN TULSA COUNTY, OKLAHOMA, FOR THE PURPOSE OF SUBMITTING TO THE REGISTERED, QUALIFIED VOTERS OF SAID COUNTY

THE QUESTION OF LEVYING AND COLLECTING A FOUR-TENTHS OF ONE PERCENT (4/10%)

SALES TAX FOR THE PURPOSE OF ARKANSAS RIVER CORRIDOR DEVELOPMENT WITHIN TULSA

COUNTY, OKLAHOMA, AND/OR TO BE APPLIED OR PLEDGED TOWARD THE PAYMENT OF

PRINCIPAL AND INTEREST ON ANY INDEBTEDNESS, INCLUDING REFUNDING INDEBTEDNESS,

INCURRED BY OR ON BEHALF OF TULSA COUNTY FOR SUCH PURPOSE; PROVIDING BALLOT

TITLE; PROVIDING FOR NOTICE TO TULSA COUNTY ELECTION BOARD, POLLING PLACES AND

CONDUCT OF SUCH ELECTION; AND PROVIDING FOR COMMENCEMENT AND DURATION OF SUCH

SALES TAX.

WHEREAS, it is deemed

necessary and advisable by the Board of County Commissioners of Tulsa County,

Oklahoma, to improve the general economic conditions and quality of life of the

people of Tulsa County, Oklahoma, by development of the Arkansas River corridor

within the County; and

WHEREAS, there are no

funds in the treasury for such purpose and power is granted said County by

Title 68, Oklahoma Statutes 2001, Section 1370, as amended, to levy and collect

a sales tax to provide funds for such purpose providing the same be authorized

by a majority of the registered voters thereof voting at an election duly held

for such purpose.

Section 1. There is hereby called a special election in Tulsa County to be held on the 9th day of October, 2007, for the purpose of submitting to

the registered voters thereof the following proposition:

PROPOSITION

"SHALL THE COUNTY OF TULSA, OKLAHOMA, BY ITS BOARD OF COUNTY COMMISSIONERS, LEVY AND COLLECT A FOUR-TENTHS OF ONE PERCENT (4/10%) SALES TAX FOR THE

PURPOSE OF ARKANSAS RIVER CORRIDOR DEVELOPMENT WITHIN TULSA COUNTY, OKLAHOMA,

AND/OR TO BE APPLIED OR PLEDGED TOWARD THE PAYMENT OF PRINCIPAL AND INTEREST ON

ANY INDEBTEDNESS, INCLUDING REFUNDING INDEBTEDNESS, INCURRED BY OR ON BEHALF OF

TULSA COUNTY FOR SUCH PURPOSE, SUCH SALES TAX TO COMMENCE ON JANUARY 1, 2008,

AND CONTINUING THEREAFTER TO DECEMBER 31, 2014?"

Section 2. The ballot setting forth the above proposition

shall also contain in connection with the said proposition the following words:

FOR

The Above Proposition

AGAINST

The Above Proposition

Only the registered, qualified voters of Tulsa County, Oklahoma, may vote upon

the proposition as above set forth.

The polls shall be opened at 7:00 o'clock A.M. and shall remain open

continuously until and be closed at 7:00 o'clock P.M.

The number and location of the polling places for said election shall be the

same or the regular precinct polling places as designated for statewide and

county elections by the Tulsa County Election Board. Such election shall

be conducted by those officers designated by the Tulsa County Election Board,

which officers shall also act as counters and certify the election results as

required by law.

Section 3. The County Clerk of Tulsa County is hereby

directed to transmit a copy of this Resolution to the Secretary of the Tulsa

County Election Board immediately upon approval hereof by the Board of County

Commissioners of Tulsa County, Oklahoma.

Section 4. Subject to approval of a majority of the

registered voters of Tulsa County voting thereon as herein provided, there is

hereby levied in addition to all other taxes in effect in Tulsa County,

Oklahoma, a sales tax of four-tenths of one percent (4/10%) upon the gross

proceeds or gross receipts derived from all sales or services in Tulsa County

upon which a consumers sales tax is levied by the State of Oklahoma for the

purpose set forth in Section 7 hereof.

Section 5. The tax herein levied shall be and remain in

effect for a period commencing on January 1, 2008, and continuing thereafter to

December 31, 2014.

Section 6.

A.

For the purpose of this Section only, the following words and terms shall be

defined as follows:

1.“County” shall mean Tulsa County, Oklahoma.

2.“County Treasurer” shall mean the

Treasurer of Tulsa County, Oklahoma.

3.“Dependent” shall mean every person who

is a member of the household of the applicant and for whom applicant is

entitled to claim a personal exemption under and pursuant to the Federal income

tax laws.

4.“Family” shall mean one or more persons

living in the same household who pool their various sources of income into one

budget to achieve the effect of sharing the cost of providing for support of

the group.

5.“Household” includes all persons who

occupy a group of rooms or single room which is regarded as a housing unit when

it is occupied as separate living quarters, and when there is either:

i. Direct access from the outside

of the building or through a common hall; or

ii. Complete kitchen facilities for

the exclusive use of the occupants.

6.“Income” includes all money received

during the year and available to be used to provide support for the family or

household.

7.“Person” shall mean an individual, but

shall not include a company, partnership, joint venture, joint agreement,

association (mutual or otherwise), corporation, estate, trust, business trust,

receiver, or trustee appointed by state or federal court or otherwise,

syndicate, the State of Oklahoma, any court, city, municipality, school

district, or any other political subdivision of the State of Oklahoma or group

or combination acting as a unit, in the plural or singular number.

8.“Resident” shall mean any person who has

resided in the corporate limits of the County for the entire calendar year for

which the refund is applied.

B.

Every person desiring to make a claim for a tax rebate must submit to the

County a written application therefore, on forms to be provided by the County,

between January 1 and March 31 of the year following the year for which the

rebate is being sought, beginning with the year 2009.

C.The qualifications for senior

rebate include the following:

1.The person must be a resident of the

County.

2.The person must be sixty-five (65) years

of age or older during a portion of the year for which the rebate is being

sought.

3.The person can claim a rebate only as a

family member who contributed the greatest share of the family income and for

members of the household who are residents of the County and who are dependent

upon the said applicant.

4.No person who may be claimed as a member

of the household on another resident’s application shall be entitled to a

rebate. If a rebate is claimed on more than one application for the same

person, the County Treasurer shall determine the person entitled to claim the

rebate provided in this Section.

D.

The qualifications for low-income rebate include the following:

1. The person must meet the

eligibility criteria for the Oklahoma Sales Tax Relief Act pursuant to Title

68, Oklahoma Statutes 2001, Section 5011, as amended, OR the Oklahoma Earned

Income Tax Credit pursuant to Title 68, Oklahoma Statutes 2001, Section

2357.43, as amended, and must timely file for such with the Oklahoma Tax

Commission.

2. The person must be a

resident of the County.

3. The person can claim a

rebate only as a family member who contributed the greatest share of the family

income and for members of the household who are residents of the County and who

are dependent upon the said applicant.

4. No person may be claimed

as a member of the household on another resident’s application shall be

entitled to a rebate. If a rebate is claimed on more than one application

for the same person, the County Treasurer shall determine the person entitled

to claim the rebate provided in this

Section.

E.

If the applicant meets the requirements to qualify for a senior rebate, the

County shall rebate the sum of $25.00. If the applicant meets the requirements

to qualify for a low-income rebate, the County shall rebate the sum of

$25.00. A person may claim and shall be entitled to only one rebate,

either the senior rebate or the low- income rebate, but not both rebates.

F.

The County Treasurer is to administer the rebate program established in this

Section. He is authorized to prepare a form for application for rebate and

adopt rules and regulations as long as the same are not inconsistent with the

provisions of this Section, and shall audit and check the applications.

The amount of rebate above set forth shall apply to each year of the seven-year

program.

G.

The burden is on the applicant to establish that he is entitled to a

rebate. The County Treasurer is authorized to require reasonable

supporting information which shall be uniformly required of all

applicants. Upon an audit of the application, the County Treasurer can require all reasonable written and other information necessary to satisfy him

that the application is valid.

Should

any application be denied, the County Treasurer shall state the reasons

therefore in writing to the applicant and indicate all or the portion of the

application being denied. Such determination shall be final unless the applicant,

within thirty (30) days after such notice of determination, shall apply in

writing to the Board of County Commissioners of the County for a hearing. After

such hearing the Board of County Commissioners of the County shall give written

notice of the determination to the applicant.

An

applicant shall not be entitled to a rebate when he has been denied by the

Board of County Commissioners of the County or when he has had an opportunity

for a hearing as provided in this Section and has failed to avail himself of

the remedies herein provided.

Section 7. All valid and subsisting permits to do business

issued by the Oklahoma Tax Commission pursuant to the Oklahoma Sales Tax Code

are, for the purpose of this Resolution, hereby ratified, confirmed and adopted

in lieu of any requirement for an additional County permit for the same

purpose.

Section 8. It is hereby declared to be the purpose of this

Resolution to provide revenue for the purpose of Arkansas River corridor development

within Tulsa County, Oklahoma, and/or to be applied or pledged toward the

payment of principal and interest on any indebtedness, including refunding

indebtedness, incurred by or on behalf of Tulsa County for such purpose,

including the following projects:

|

|

Total:

|

|

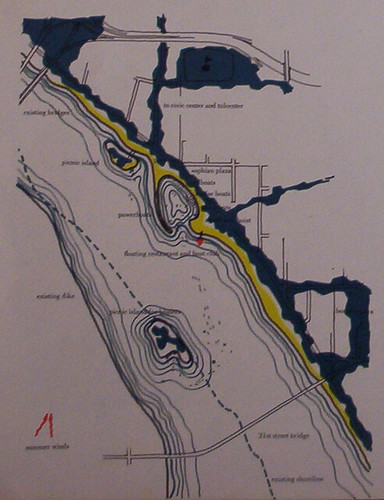

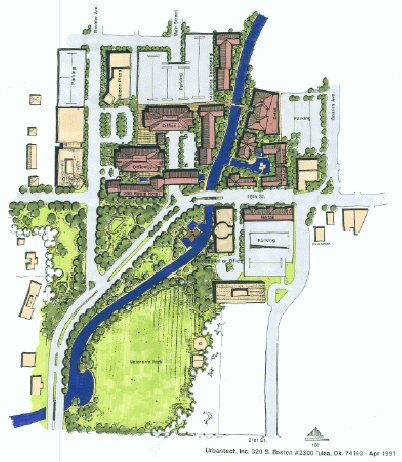

Arkansas River improvements including

but not limited to Sand Springs low water dam, pedestrian bridge and lake

($24.70 million), Zink Dam modifications ($15.45 million), modification of

river channel from Zink Lake to South Tulsa/Jenks Lake ($90 million), South

Tulsa/Jenks low water dam, pedestrian bridge and lake, and low water dam,

lake and river studies ($24.70 million).

|

$154,850,000

|

|

Arkansas River corridor land

acquisition, infrastructure, bridge improvements and site development, and

Arkansas river studies for Tulsa, Broken Arrow, Jenks, Sand Springs and

Bixby.

|

$57,400,000

|

|

Bridging East and West Arkansas River

Banks and Downtown, including but not limited to pedestrian River crossings

at 41st Street and 61st Street ($30 million), and

connectors from downtown Tulsa to the Arkansas River and transportation

corridor studies ($15 million).

|

$45,000,000

|

|

Projects Contingency

|

$25,000,000

|

While

the cost estimates shown above are believed to be accurate, it must be

recognized that the exact cost of each project may vary from the estimate

shown. It is the intention of the Board of County Commissioners of Tulsa County , Oklahoma, that all projects shall be completed as funds are made available.

The nature and scope of all projects shall be determined by a public trust

having Tulsa County, Oklahoma, the City of Tulsa, Oklahoma, and any other

municipality having its mayor as a trustee of such trust as its beneficiaries.

Such public trust shall have nine trustees consisting of, ex- officio, the

three members of the governing body of Tulsa County, Oklahoma, the Mayor of the

City of Tulsa, Oklahoma, a member of the River Parks Authority designated by

the Chairman of the River Parks Authority, two members appointed by the Mayor

of the City of Tulsa, Oklahoma, and two members appointed by the governing body

of Tulsa County, Oklahoma, one of which shall be, ex officio, the Mayor of

either Bixby, Jenks, Broken Arrow or Sand Springs, Oklahoma, and the other of

which shall be, ex officio, the Mayor of either Owasso, Glenpool, Collinsville,

Skiatook or Sperry, Oklahoma. In the expenditure of all funds hereunder,

preference shall be given to local vendors and contractors to the extent

permitted by law. In addition, such public trust shall approve any deletion or

addition of projects from those listed above and any major change in scope of

any such project following a public hearing by such trust. The Indian

Nations Council of Governments shall provide consulting services to such public

trust upon request.

Section 9. There is hereby specifically exempted from the

sales tax levied by this Resolution all items that are exempt from the State

sales tax under the Oklahoma Sales Tax Code.

Section 10. The tax levied hereunder shall be due and

payable at the time and in the manner and form prescribed for payment of the

State sales tax under the Oklahoma Sales Tax Code.

Section 11. Such sales taxes due hereunder shall at all

times constitute a prior, superior and paramount claim as against the claims of

unsecured creditors, and may be collected by suit as any other debt.

Section 12. The definitions of words, terms and phrases

contained in the Oklahoma Sales Tax Code, Title 68, Oklahoma Statutes 2001,

Section 1352, as amended, are hereby adopted by reference and made a part of

this Resolution.

Section 13. The term "Tax Collector" as used

herein means the department of the County government or the official agency of

the State duly designated according to law or contract authorized by law to

administer the collection of the tax herein levied.

Section 14. For the purpose of this Resolution the

classification of taxpayers hereunder shall be as prescribed by state law for

purposes of the Oklahoma Sales Tax Code.

Section 15. (a) The tax herein levied shall be paid

to the Tax Collector at the time in form and manner provided for payment of

State sales tax under the Oklahoma Sales Tax Code. (b) The bracket system

for the collection of the sales tax provided for herein by the Tax Collector

shall be as the same is hereafter adopted by the agreement of the Board of

County Commissioners of Tulsa County, Oklahoma, and the Tax Collector, in the

collection of both the sales tax provided for herein and the State sales tax.

Section 16. (a) The tax levied hereunder shall be

paid by the consumer or user to the vendor, and it shall be the duty of each

and every vendor in this County to collect from the consumer or user, the full

amount of the tax levied by this Resolution, or any amount equal as nearly as

possible or practicable to the average equivalent thereof.

(b) Vendors shall add the tax imposed hereunder,

or the average equivalent thereof, to the sales price, charge, consideration,

gross receipts or gross proceeds of the sale of tangible personal property or

services taxed by this Resolution, and when added such tax shall constitute a

part of such price or charges, shall be debt from the consumer or user to

vendor until paid, and shall be recoverable at law in the same manner as other

debts.

(c) A vendor who willfully or intentionally

fails, neglects or refuses to collect the full amount of the tax levied by this

Resolution, or willfully or intentionally fails, neglects or refuses to comply

with the provisions hereof or remits or rebates to a consumer or user, either

directly or indirectly, and by whatsoever means, all or any part of the tax

herein levied, or makes in any form of advertising, verbally or otherwise, any

statement which infers that he is absorbing the tax, or paying the tax for the

consumer or user by an adjustment of prices or at a price including the tax, or

in any manner whatsoever, shall be deemed guilty of an offense, and upon

conviction thereof shall be fined not more than One Hundred Dollars ($100.00),

plus costs, and upon conviction for a second or other subsequent offense shall

be fined not more than Five Hundred Dollars ($500.00), plus costs, or incarcerated

for not more than sixty (60) days, or both. Provided, sales by vending

machines may be made at a stated price which includes state and any municipal

sales tax.

(d) Any sum or sums collected or required to be

collected hereunder shall be deemed to be held in trust for Tulsa County,

Oklahoma, and, as trustee, the collecting vendor shall have a fiduciary duty to

Tulsa County, Oklahoma in regards to such sums and shall be subject to the

trust laws of this state. Any vendor who willfully or intentionally fails

to remit the tax, after the tax levied by this article was collected from the

consumer or user, and appropriates the tax held in trust to his own use, or to

the use of any person not entitled thereto, without authority of law, shall be

guilty of embezzlement.

Section 17. Returns and remittances of the tax herein

levied and collected shall be made to the Tax Collector at the time and in the

manner, form and amount as prescribed for returns and remittances required by

the Oklahoma Sales Tax Code; and remittances of tax collected hereunder shall

be subject to the same discount as may be allowed by the Oklahoma Sales Tax

Code for collection of State sales tax.

Section 18. The provisions of Title 68, Oklahoma

Statutes 2001, Section 217, as amended, and of Title 68, Oklahoma Statutes

2001, Sections 1350 et seq., as amended, are hereby adopted by reference and

made a part of this Resolution, and interest and penalties at the rates and in

amounts as therein specified are hereby levied and shall be applicable in cases

of delinquency in reporting and paying the tax levied by this Resolution.

Provided, that the failure or refusal of any taxpayer to make and transmit the

reports and remittances of tax in the time and manner required by this

Resolution shall cause such tax to be delinquent. In addition, if such

delinquency continues for a period of five (5) days the taxpayer shall forfeit

his claim to any discount allowed under this Resolution.

Section 19. The interest or penalty or any portion thereof

accruing by reason of a taxpayer's failure to pay the sales tax herein levied

may be waived or remitted in the same manner as provided for such waiver or

remittance as applied in administration of the State sales tax provided in

Title 68, Oklahoma Statutes 2001, Section 220, as amended; and to accomplish

the purposes of this section the applicable provisions of such Section 220 are

hereby adopted by reference and made a part of this Resolution.

Section 20. Refund of erroneous payment of the sales

tax herein levied may be made to any taxpayer making such erroneous payment in

the same manner and procedure, and under the same limitations of time, as

provided for administration of the State sales tax as set forth in Title 68,

Oklahoma Statutes 2001, Section 227, as amended, and to accomplish the purposes

of this Section, the applicable provisions of such Section 227 are hereby

adopted by reference and made a part of this Resolution.

Section 21. In addition to all civil penalties

provided by this Resolution, the willful failure or refusal of any taxpayer to

make reports and remittances herein required, or the making of any false and

fraudulent report for the purpose for avoiding or escaping payment for any tax

or portion thereof rightfully due under this Resolution shall be an offense,

and upon conviction thereof the offending taxpayer shall be subject to such

fines as set out under Title 68, Oklahoma Statutes 2001, Section 241, as

amended.

Section 22. The confidential and privileged nature of the

records and files concerning the administration of this sales tax is

legislatively recognized and declared, and to protect the same the provisions

of Title 68, Oklahoma Statutes 2001, Section 205, as amended, of the Oklahoma

Sales Tax Code, and each subsection thereof is hereby adopted by reference and

made fully effective and applicable to administration of this sales tax as if

here set forth in full.

Section 23. The people of Tulsa County, Oklahoma, by their

approval of the proposition set forth in Section 1 of this Resolution at the

election hereinabove provided, hereby authorize the Board of County

Commissioners of Tulsa County, Oklahoma, by Resolutions duly enacted to make

such administrative and technical changes or additions in the method and manner

of administration and enforcing this Resolution as may be necessary or proper

for efficiency and fairness except that neither the rate of the tax herein

provided, nor the term, nor the purpose of the tax herein provided, shall be

changed without approval of the qualified electors of the County as provided by

law.

Section 24. The Board of County Commissioners of Tulsa

County, Oklahoma, hereby declares for the benefit of the taxpayers of Tulsa

County, Oklahoma, its solemn intent that the sales tax levied pursuant to this

Resolution be ended at the earliest possible time upon payment of all

indebtedness secured by such sales tax, or adequate provision for such payment

having been made, and sufficient funds collected for all projects contemplated

hereunder.

Section 25. The provisions hereof shall be cumulative, and

in addition to any and all other taxing provisions of County Resolutions.

Section 26. The provisions hereof are hereby declared to be

severable, and if any section, subsection, paragraph, sentence or clause of

this Resolution is for any reason held invalid or inoperative by any Court of

competent jurisdiction such decision shall not affect any other section,

subsection, paragraph, sentence or clause hereof.”

PASSED AND APPROVED this 9th day of August, 2007.

BOARD OF COUNTY COMMISSIONERS OF TULSA COUNTY , OKLAHOMA

__________________________________

Randi Miller, Chairman

Board of County Commissioners

ATTEST:

____________________________

Earlene Wilson, County Clerk

(SEAL)