Candidate background checks: Part 3: Dewey Bartlett Jr and his "best managerial efforts"

NOTE: The information and analysis regarding this are derived entirely from the public record pertaining to the case, as found in the records of the Tulsa County Court Clerk and the Oklahoma State Courts Network (OSCN) online database. Links or photographic images are provided for relevant excerpts from those records.

In their August 23, 2009, story on the legal tribulations of candidates for City of Tulsa office, the Tulsa World missed some interesting information. One was a court case involving Republican mayoral candidate Dewey Bartlett Jr., a case that went to the Oklahoma Court of Civil Appeals and nearly went to the Oklahoma Supreme Court.

Documents in the case shed some light on Bartlett's financial acumen, undercutting a key selling point in his campaign for Mayor of Tulsa. One of the motions filed by Bartlett Jr's attorneys states that he and his wife "lived a lifestyle which exceeded Dewey's salary and thus consumed a large portion of Dewey's separate estate." A spreadsheet included in that same motion indicates that Bartlett Jr, having inherited a large estate, managed over time to turn it into a somewhat smaller estate.

That point was made explicitly (by Dewey Jr's lawyer) elsewhere in the same document, that "despite Dewey's best managerial efforts, there was no enhancement in the value of Dewey's inherited estate..." during a period that included one of the longest and strongest bull markets in American history.

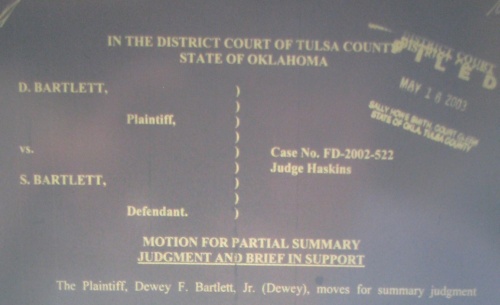

The case, "Bartlett D. v. Bartlett S.," FD-2002-522, involved Dewey Bartlett Jr filing for divorce against his wife, Susan Bartlett, on February 6, 2002, five weeks before their 20th wedding anniversary. Previously, on August 10, 2000, Susan had filed for separate maintenance. She filed a dismissal of that case (FD-2000-3454) on July 17, 2001.

The OSCN case summary suggests (to my untrained eye, at any rate) that this was anything but a quick, amicable, uncontested divorce. In his petition for divorce, Dewey Jr "allege[d] that a state of complete and irreconcilable incompatibility has arisen between the parties hereto which has completely destroyed the legitimate aims of the marriage of the parties and rendered its continuation impossible by reason of which the parties are entitled a Decree of Divorce each from the other." In her answer, Susan "denie[d] that the parties' relationship is such that the Court should award a divorce to either party." The trial was not held until January 2004, nearly two years after the case was filed. There were contempt citations and a what looks like a battle over attorney fees. The divorce decree was issued on July 15, 2004, but the case continued to see activity until October 17, 2007, when a mandate was signed by District Judge David Youll.

The case went to the Court of Civil Appeals because Dewey Jr claimed that their family home on 26th Street was his separate property and was not marital property, because it had been purchased and improved with money from his inheritance. Judge Youll agreed with Dewey Jr, but Susan appealed the decision.

(An interesting note: As of June 1, 2009, Dewey Jr was still registered to vote at the 26th St. house, although on July 13, 2009, he filed for mayor listing an address on 30th Place, where his current wife, Victoria, is registered to vote)

The three-judge appeals court panel reversed Youll on this point, noting that the house was first in joint tenancy and was, in 1997, conveyed to Susan's separate trust. The court's opinion states, "In this case, Husband and Wife lived together in the home for nearly fifteen years. They lived there together for five years after conveying the home to Wife's revocable trust. And, both began the divorce proceedings claiming the home was marital. Necessarily, however, transferring marital property to Wife's trust could not convert what was marital property into Husband's separate property." (See the extended entry for a longer excerpt from the opinion.)

On May 16, 2003, Dewey Jr filed a "Motion for Partial Summary Judgment and Brief in Support," mostly dealing with what constitutes his separate property. A spreadsheet attached as Exhibit "B" to the motion shows a summary of the Bartletts' net worth on five dates. Here are those dates with the footnotes to the spreadsheet, and the family's estimated net worth, summing what Dewey Jr claimed as his separate property, Susan's separate property, and their joint property. (Below you will find a link to a PDF of this motion with a separate PDF containing the spreadsheet only.)

The document is interesting for a couple of reasons. At this point in the proceedings, Dewey Jr classified the house on 26th St as marital property; at some point between this filing and the July 2004 divorce decree, he claimed it as his separate property. That claim created the issue that took the case to the appeals court.

But it's also interesting because it gives voters some hard data to evaluate Bartlett's claim to be a successful businessman who can help Tulsa create jobs and grow the local economy. We can see what Bartlett has done, by his own account, with the considerable amount of wealth he inherited.

- June 1987, "Pre D. A. Bartlett Trust Distribution": "Earliest financial statement located post-marriage, but pre-distribution from the David A. Bartlett Trust. Dewey owned 3.8701% of Keener Oil Co. at this time." Net worth listed as $576,167. The following month he would receive a trust distribution valued at $2,693,676.

- December 1987, "Post D. A. Bartlett Trust Distribution": "In July of 1987 Dewey received $697,884 in cash and cash items from the David A. Bartlett Trust. He also received an additional 22.7486% interest in Keener Oil Co. from the Trust, plus a 1/3 interest in 792 acres in Delaware Cty." Net worth listed as $3,361,354.

- December 1994, "Post Liquidation of Keener Oil Co.": "In the first six months of 1994 Keener Oil Co. was essentially liquidated. Dewey received approximately $900,000 cash and oil & gas properties. He contributed the properties to a newly formed corporation, Keener Oil & Gas Co., which he owned 100%. He was also entitled to receive 1/3 of the overfunding of the Keener Oil Co.'s pension plan when IRS approval to terminate was obtained (approximately $380,000)." Net worth listed as $4,551,825.

- December 2000, "Post Sale of Delaware Cty. Property": "In the later portion of 2000 the Delaware Cty. property owned 1/3 each by Dewey and his brother and sister was sold. Dewey received approximately $470,000 in cash and Osage Cty. real estate for his1/3 interest. With a portion of that cash Dewey purchased equipment for the Osage Cty. pecan farm." Net worth listed as $4,506,100.

- October 2002, "Current Position": "Dewey spent part of the cash he received form [sic] the sale of his Delaware Cty. property to purchase the condominium he is living in. He also purchased additional pecan farm equipment from the cash proceeds of the Delaware Cty. sale." Net worth listed as $3,613,000.

The additional assets received in the July 1987 trust distribution were valued, according to Dewey Jr's court filing, at $1.5 million (his additional interest in Keener Oil Co.) and $495,792 (his 1/3 interest in the Delaware County acreage). With the "cash and cash items," that amounts to an inherited boost to his bottom line of $2,693,676.

This statement appears on page 4 of the May 16, 2003 motion (emphasis added):

It is also undisputed that, despite Dewey's best managerial efforts, there was no enhancement in the value of Dewey's inherited estate during the course of the marriage. In fact, the value of Dewey's inherited estate declined during coverture through depletion or depreciation. Dewey managed his inheritance by transferring assets among and between the various components of his total inheritance.

As a point of comparison, between December 1994 and December 2000, the S&P 500 nearly tripled in value, but the Bartlett family's net worth declined slightly from $4,551,825 to $4,506,100, according to the spreadsheet mentioned above. Expanding the focus to the period from December 1987 to October 2002, the value of the S&P 500 was multiplied by 3.55 (increased by 255%), while the Bartlett family's net worth (according to Dewey Jr) increased by only 7%.

In other words, "Dewey's best managerial efforts" were an order of magnitude less successful than the simple act of putting everything in an S&P 500 index fund.

Here are PDF files of the key documents cited above. These are composed of photographs of the microfilm machine screen. The photos have been edited only in three ways -- rotated to portrait orientation, cropped to show only the page and not the microfilm machine, and bank account numbers redacted. These documents are public record and can be accessed at the microfilm department of the Tulsa County Court Clerk's office. (The original case record is so bulky that it cannot ordinarily be checked out; instead, individual documents have to be accessed on the microfilm reel for the day the document was filed with the court.)

- Dewey Bartlett Jr's petition for divorce (3 MB PDF)

- Susan Bartlett's answer to divorce petition (2 MB PDF)

- Dewey Bartlett Jr's May 16, 2003, motion for partial summary judgment:

- Background section only (includes the quotes mentioned above) (2 MB PDF)

- Exhibit B spreadsheet of the Bartletts' net worth from 1987 to 2002 (9 MB PDF)

- Full 18 pages of motion and brief, plus Exhibits A and B and Dewey Jr's affidavit, which includes a record of his annual salary for the years from 1987 to 2002 (16 MB PDF)

Here are some extended excerpts from the Civil Court of Appeals's decision, knocking down Dewey Jr's arguments that the family home should be reckoned as his separate property:

¶4 Wife first asserts the trial court erred in finding that many of the disputed assets were Husband's separate property and had not become marital property by commingling or transmutation. During the marriage, the parties bought a house, using Husband's separate funds, which was conveyed by the sellers to Husband and Wife in joint tenancy. Husband also placed six other parcels of land in joint tenancy with Wife. In 1997, the parties conveyed the house and an undivided half interest in the remaining joint tenancy properties to Wife's separate trust (at the same time they conveyed an undivided half interest to Husband's separate trust). One of the issues at trial was whether the house and other real properties were separate or marital property....¶6 The trial court made separate findings regarding the parties' marital residence and we address that property first. The trial court found that Husband acquired the house during the marriage with "funds whose origin is traced to [Husband's] separate property to include a family trust, direct inheritance, or from sale of property received by [Husband] through trust or inheritance." 1 The parties purchased the home in 1987, well before the parties began their estate planning measures, and the sellers conveyed the home to Husband and Wife as joint tenants. The testimony and evidence shows that Husband treated the home as marital property until he testified at trial. Additionally, the evidence does not indicate a non-gift purpose for taking title to the house in joint tenancy when the parties purchased the home in 1987. As explained in footnote 1, above, Husband testified he had treated the house as marital property, but that he did not intend a gift of half an interest in the home to Wife.

¶9 Husband's only testimony about his intent at the time the house was initially purchased was that he never intended a gift. Husband agreed he had treated the home as marital property until the time of trial. Neither of these facts support a finding by clear and convincing evidence that a collateral purpose existed at the time the house was acquired. The parties' estate planning measures, which involved conveying the house to Wife's separate trust ten years after the parties originally purchased the house, could not have converted the property to Husband's separate property, because at that time the house was a marital asset. Husband's declaration at trial, over fifteen years after the house was acquired in joint tenancy, that he did not intend a gift, without more, does not provide clear and convincing evidence of a purpose collateral to intending a gift. In this case, the parties did not create their estate planning trusts until 1997. Although the parties may have conveyed the house to Wife's trust for estate planning purposes in 1997, the presumption is that the home had become marital property by gift at the time it was purchased, and we have noted Husband presented insufficient evidence of a non-gift purpose to rebut that presumption. Accordingly, the home was marital property.

¶10 However, in 1997, the parties conveyed the marital residence by warranty deed to Wife's revocable trust. The home remained titled solely in Wife's revocable trust at the time of the divorce proceedings. As a result, there is an issue whether the parties intended to gift that marital asset to the separate estate of Wife, or whether the home remained marital at the time of divorce....

¶12 The opinion of the Oklahoma Court of Civil Appeals in Dorn v. Heritage Trust Co., 2001 OK CIV APP 64, 24 P.3d 886, suggests the home in this case remained marital after it was conveyed to Wife's trust, even if that was done for estate planning purposes. 4 In this case, Husband and Wife lived together in the home for nearly fifteen years. They lived there together for five years after conveying the home to Wife's revocable trust. And, both began the divorce proceedings claiming the home was marital. Necessarily, however, transferring marital property to Wife's trust could not convert what was marital property into Husband's separate property.

¶13 We therefore reverse the finding that the home was Husband's separate property. We remand this matter to the trial court to determine, based on the analysis in Manhart and Dorn, whether the home remained marital at the time of divorce, or whether the parties succeeded in making a gift of the home to Wife's separate estate when they conveyed the home to Wife's separate trust. If the trial court determines the home retained its status as marital property despite being conveyed to Wife's trust, the trial court must equitably divide that asset. 43 O.S.2001 §121. Or, if the trial court determines the parties gifted this marital property to Wife's separate estate, then the trial court must set that property aside to Wife. Id.

2 TrackBacks

Listed below are links to blogs that reference this entry: Candidate background checks: Part 3: Dewey Bartlett Jr and his "best managerial efforts".

TrackBack URL for this entry: https://www.batesline.com/cgi-bin/mt/mt-tb.cgi/5243

Welcome, new readers! Click this link to read the blog article in question regarding Dewey Bartlett Jr's divorce filings and what his own side's assertions tell us about his financial acumen. Did Bartlett Jr fairly characterize what I posted? Read the ... Read More

Tulsa Mayor Dewey F. Bartlett Jr. has announced his intention to run for a third term. Federal lobbyist and City Councilor G. T. Bynum IV has announced his intention to run against Bartlett. My one-word take: Feh. Tulsa needs better choices. (I won't s... Read More

Thank you for taking the time to review so many documents. I hope I can put some perspective on the Court proceedings (for whatever it may be worth):

1) It is not uncommon for divorces to drag on years. Generally, it is more a measure of the presence of children and the extent of assets than a reflection on the parties. This case was certainly extensive, but with the estate values you referenced it is not entirely surprising.

2) Contempt hearings/decrees in divorce cases are the oppositions way of complaining and forcing conduct, they are not uncommon at all. They may or may not have merit and generally are not the same nefarious conduct one associates with a contempt of court. It might be as simple as an attorney neglecting discovery materials for too long or one party refusing to turnover a particular article of property.

3) Contempt citations lead to attorney fees. "If you would have done what you were told I would not have had to spend money in court making you do so." Also not uncommon.

*** I have no inside knowledge in the referenced case nor any dealings with the parties.

Thanks very much for the background info. (For the rest of you -- I know who this is, and he is indeed an attorney.)

Thanks for doing this work, Mike. I prefer to make an informed decision when I go to the polls, and you are making that easier for me. I hope you scrutinize all the candidates!

Thanks, Betsy. I'll do the best I can with the limited time I have.

Wow, best write up about a candidate running for Mayor in Tulsa yet. I am going to get this up on newsfifty.com for more people to see.

It is interesting, but it is not a write-up about a candidate for mayor. It is a write-up about a candidate's divorce. Divorce among the wealthy are often interesting in that train-wreck way.

Does this mean Bartlett could not be a good mayor? No. At least not in the same way as someone who thinks a creation exhibit at the zoo is the City's top priority. Jim Inhofe's family relations have been messy, too. Do his supporters care? No. Do those issues help his opponents? No.

I don't think Bartlett would be a good mayor, but his divorce or his trust has nothing to do with it. Adelson has not been divorced, as far as I know, but that doesn't mean he would be a good mayor.

The kind of scrutiny this article offers is one of the reasons many people don't seek public office. Maybe it serves a purpose, maybe it is only to hit a candidate's soft spot. I'm not a Bartlett supporter, but I just don't see the point.

I agree in part with Brooksider. Just because you go through a messy divorce doesn't mean you won't be effective as a mayor.

Case in point: Rudy Giuliani.

So I don't see a lot of relevance in the two things.

Mike's point doesn't hinge on the fact of Dewey's divorce, but upon the info that process made public. Namely managment of finances. In stark contrast to Dewey's central (nearly only) campaign plank (he's a great businessman), the actual record shows he's at best a businessman who did not succeed at trashing the business he inherited.

Roy is right. This wouldn't be relevant except that Dewey Jr's business skills are the core of his campaign pitch.

Inhofe's business disputes with his brother Perry were thoroughly aired in the press during his earlier campaigns for Congress, contemporaneous with those disputes. There were even bumper stickers, which said something like, "Inhofe family values: Sue your brother."

Many readers are trying to discredit Bates' research by saying that the divorce proceedings are irrelevant, which ultimately, they are.

Bates did not publish the information to pass judgement on Bartlett because he is a divorcee. Instead, these records prove that Bartlett is a shoddy businessman because he failed to increase his estate during an optimal time for growth.

In other words, Bartlett lives lavishly from his inheritance, but contributes little. Do we really want a lazy trust fund kid running our city?