Tulsa suburbs: October 2012 Archives

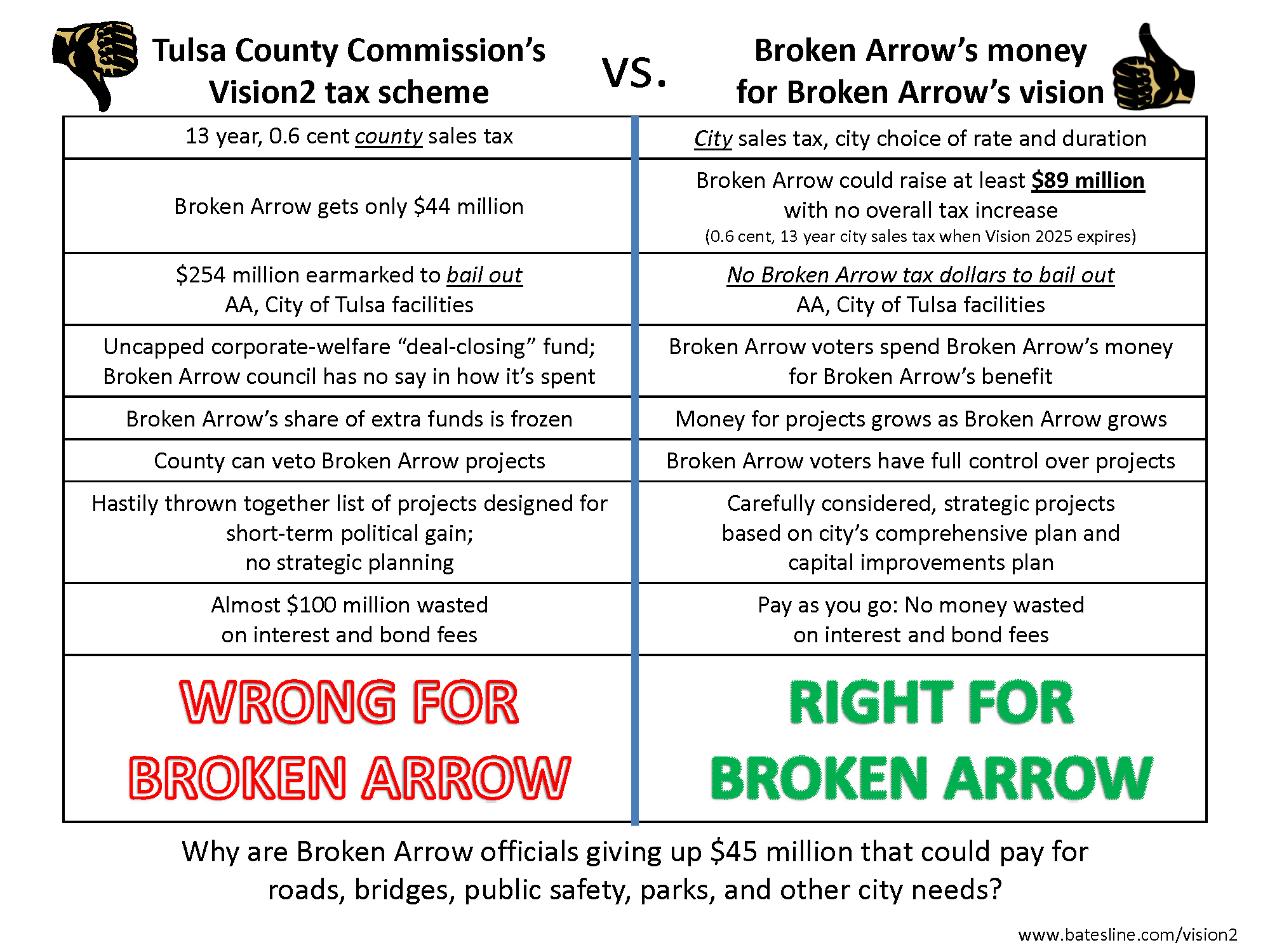

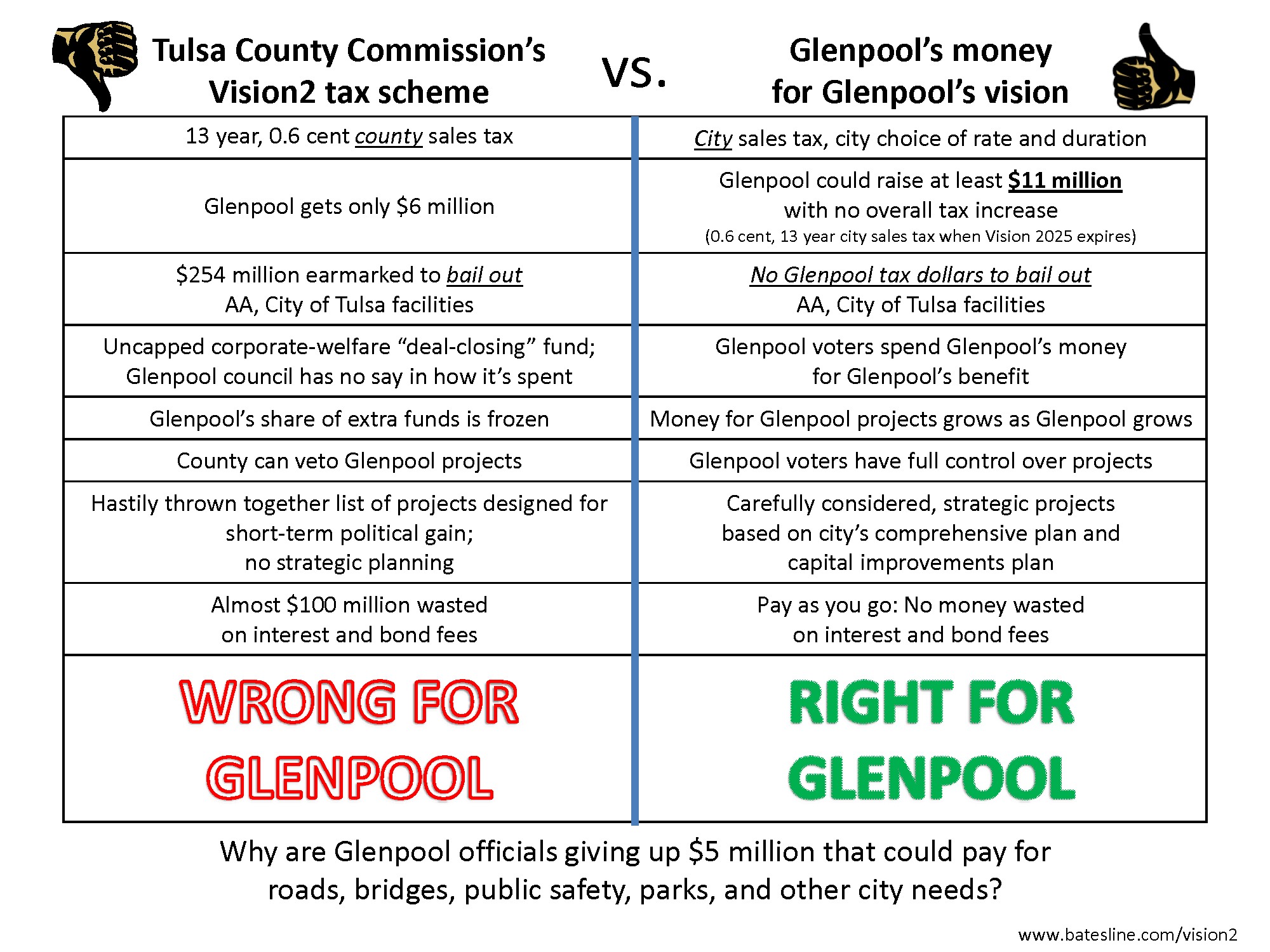

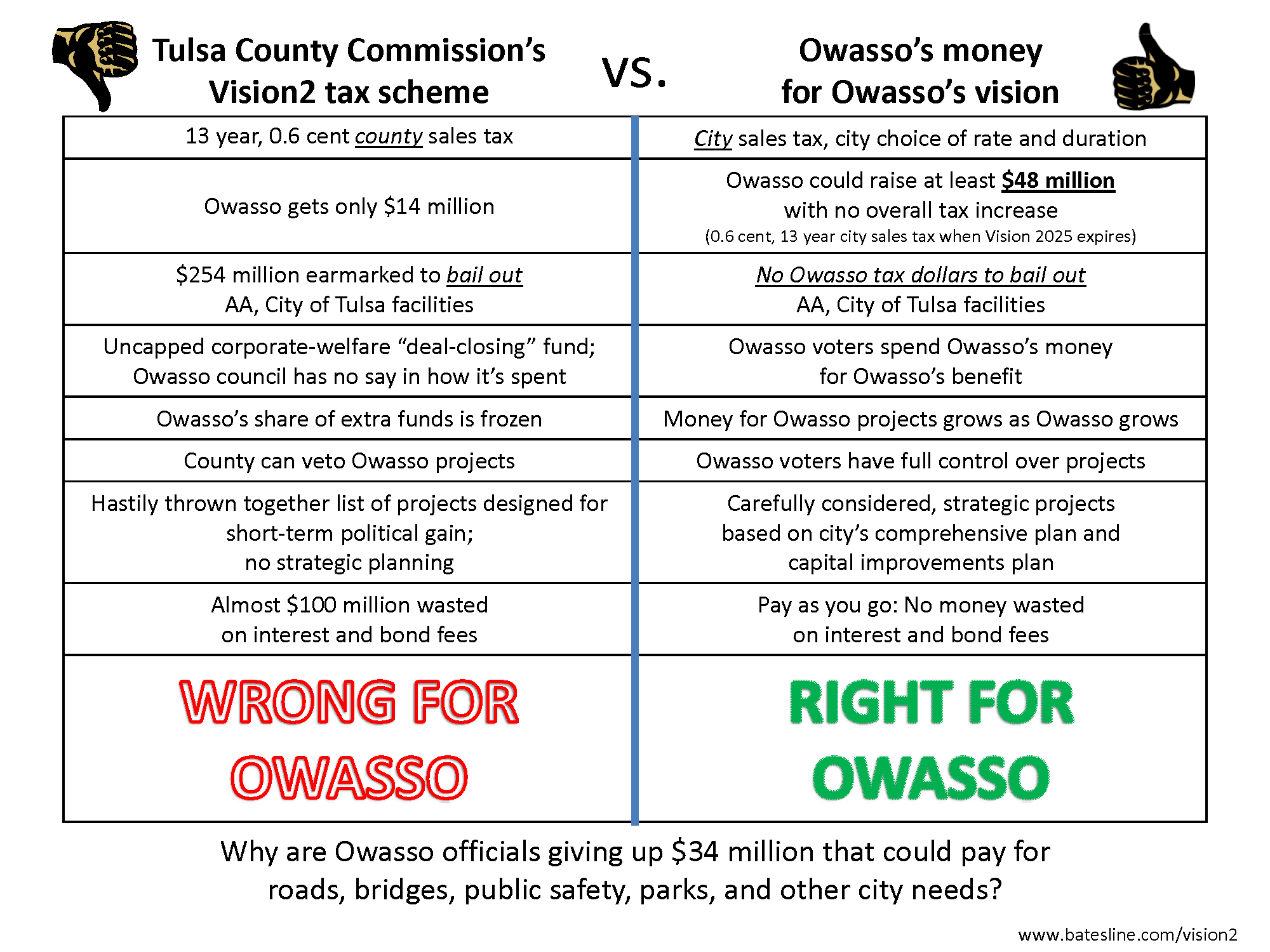

I've started to put together a series of fliers explaining why Vision2 hurts Tulsa County's municipalities and how these cities would be better off enacting a city sales tax to replace the Vision 2025 county sales tax when it expires on the last day of 2016. Here are the first three, for Broken Arrow, Glenpool, and Owasso.

You'll notice that most of the reasons are the same from city to city. The key difference is in the money each city would get from Vision2 vs. how much they would get from a city tax of the same rate and duration. This tax would go into effect as soon as Vision 2025 expires, so that the overall sales tax rate wouldn't change.

The Vision2 amounts for each city are those that the proponents have publicized. The estimate of money that could be raised by a city sales tax of the same rate and duration is based on each city's sales tax receipts for the 12 months from October 2011 through September 2012. (One year's sales tax receipts / sales tax rate * 0.6% * 13 years.) I've rounded all numbers to the nearest million.

One of the big drawbacks of Vision2 for a growing suburb is that its percentage of the Vision2 Prop 2 tax receipts is frozen in time, based on its share of county population in 2010, no matter how much they grow in population and retail sales. By contrast, a city sales tax would grow as the city grows.

Click each image to download a corresponding ready-for-printing PDF. Opponents of Vision2 are welcome to copy and hand these out as long as you don't change it at all.

All images Copyright 2012 by Michael D. Bates. Limited license granted to opponents of Vision2 to copy and distribute without alteration prior to November 7, 2012.