Tulsa City Hall: August 2012 Archives

Tulsa Mayor Dewey Bartlett Jr is holding the first in a series of Vision2 public forums tonight (August 27, 2012, Webster High School, 5:30 to 7:30 pm) to ask what projects should be funded with the money the county would <sarcasm>graciously</sarcasm> allow the city to have. Never mind that no public forums were held before the Tulsa County Commission decided to put the three-quarters-of-a-billion-dollars sales tax extension on the November ballot.

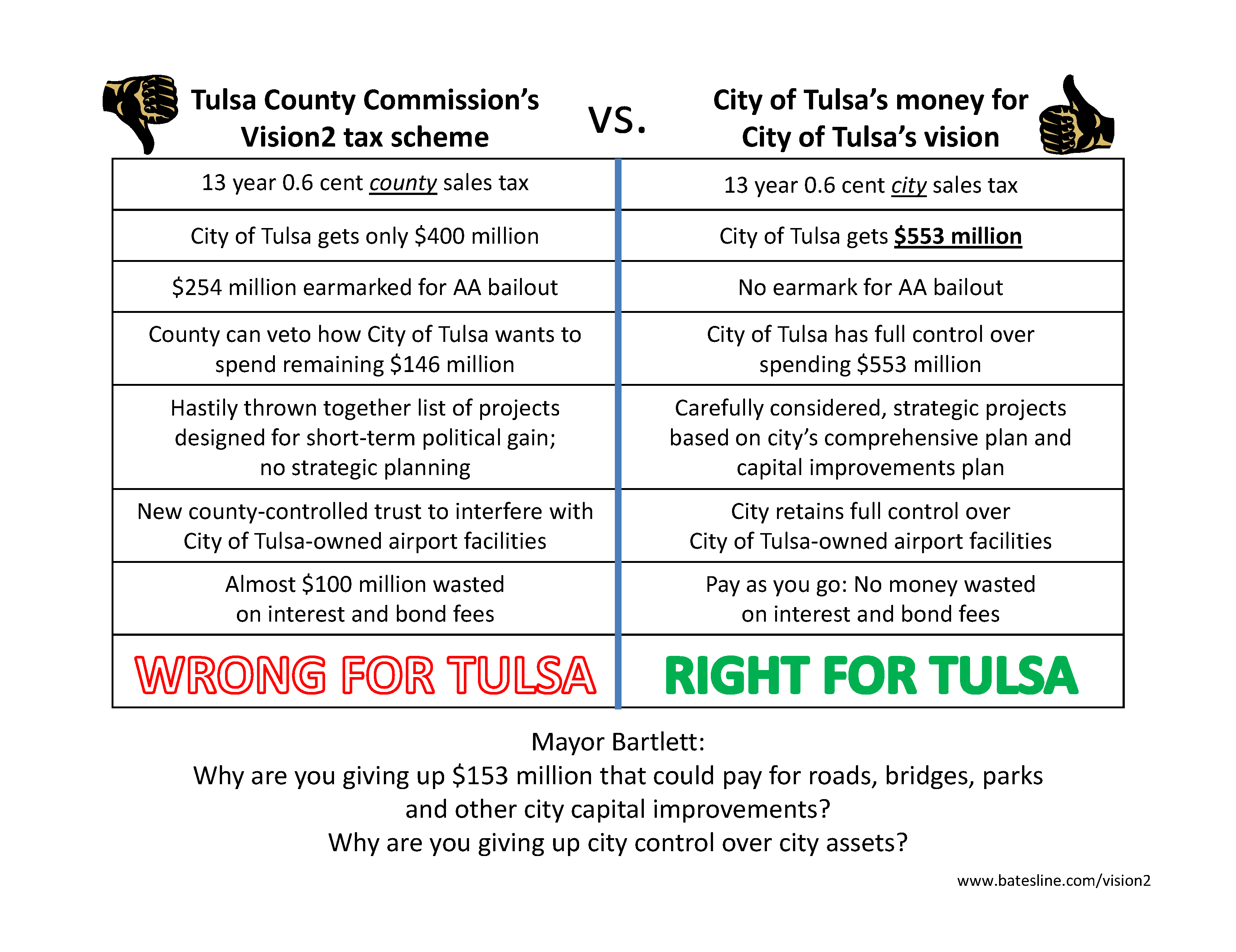

Tulsa voters should ask the mayor why any Tulsan should support a Tulsa County scheme that shorts our city $153 million in funds for roads, parks, and other capital projects, a scheme that gives another government body a say in city-owned airport properties, a scheme that gives the Tulsa County Commission veto power over the City of Tulsa's list of projects.

I've put together a simple chart (PDF format) comparing the Tulsa County Commission's Vision2 tax scheme with a plan that spends the City of Tulsa's money to implement the City of Tulsa's vision. You may find it helpful to print out and share with His Honor and His Honor's staffers this evening as you ask him why he's backing a plan that puts the City of Tulsa at such a significant disadvantage. (More here on the math behind the numbers on the chart -- why the City of Tulsa would be better off going it alone and taking over the Vision 2025 0.6 cent tax as a city tax when the Vision 2025 tax expires at the end of 2016.)

A possible response to my earlier entry, Vision2 share vs. Tulsa County municipality population, is that it doesn't count the money in Proposition 1 to improve city-owned facilities and to provide "equipment and fixtures and other capital improvements" for businesses in the "Airport Industrial Complex" as part of Tulsa's share.

Even if that were a wise way to spend $254 million -- and it's not -- the City of Tulsa and its citizens would be far better off financially if the City opposed the Vision2 county tax and raised the city sales tax by the same amount.

There's precedent for the idea: Way back in 2008, when we were debating different approaches to fixing our streets, Councilor Bill Martinson proposed that the city take over county sales tax streams as they expired -- adding two-twelfths of a cent when the County's "4 to Fix the County, Part II" tax expired in 2011, and adding 0.6% when the County's Vision 2025 tax expired at the end of 2016. The overall sales tax would remain the same at 8.517%, but most of the county's share would be shifted to pay for city capital improvements that directly affect our quality of life. The plan ultimately adopted by the City Council and the voters captured the "4 to Fix" 2/12ths, but left the Vision 2025 tax untouched.

Over the last 12 months, the City of Tulsa has collected about $71 million per penny of sales tax revenue. Over 13 years at that level of sales tax collection, the 0.6% sales tax under discussion would generate $553.8 million in revenue for the City of Tulsa. Deduct the $254 million AA bailout from that number, and there'd still be almost $300 million that the City of Tulsa could spend on the priorities in its capital improvements process. Better still, that money would be spent under the tighter competitive bidding laws that apply to the city and the city's more transparent approach to picking projects for capital improvements sales tax packages, a process that has its roots in the Inhofe mayoralty and the original 3rd Penny.

So under the Vision2 plan adopted by the Tulsa County Board of Commissioners, the City of Tulsa would get a $400 million share -- if you count the American Airlines bailout in that amount. If instead the City of Tulsa adopted its own 0.6%, 13 year sales tax, the City of Tulsa would get $553.8 million. For the same overall sales tax level, City of Tulsa would be better off by $153.8 million, a nearly 40% increase in money available for capital improvements.

I can't imagine any rational, honest reason for any City of Tulsa official to go along with Tulsa County's sales tax scheme.

AND ANOTHER THING: Under the Tulsa County Vision2 scheme, the City of Tulsa has to get the County Commission's approval on how the city spends it's share of the Proposition 2 municipal pork barrel bribery fund.

Projects shall be identified by the governing body of each Political Subdivision following public hearing and input of public comment, in such form and process as determined by such governing body, and shall be submitted to the Board of County Commissioners of Tulsa County, Oklahoma to determine whether the sales tax collected pursuant to this Resolution may be properly expended for such Project.