Tulsa County: September 2007 Archives

If the Vision 2025 Sales Tax Overview Committee is as diligent and vigilant a watchdog as we're being told they are, how did they miss noticing that the arena was going to go way over budget when there was time to prevent the crisis?

If Hurricane Katrina caused the arena to go more than $50 million over budget, how come it didn't have a similar effect on the cost of any other project?

The Tulsa County Vision Trust decided to allocate extra funding to the arena, because the estimated cost was wrong. Couldn't they have done the same thing for the low-water dams and Zink Dam work promised in Vision 2025? And couldn't they have decided to allocate less of the surplus receipts for the arena and hold some surplus back for the dams?

Some of my fellow Tulsa bloggers are wondering about the river tax, too. First, let's hear from some bloggers that are new to me

Jason Kearney writes that "[n]o one was a bigger supporter of Vision 2025" than he was, but he's voting no on the October 9th sales tax increase. Among some of his many reasons:

For example, developers do not REQUIRE tax dollars to move forward with these projects, they just WANT them. Who wouldn't? I can understand the county giving them a tax break for a few years, but they do not need tax dollars. County Commissioner Randi Miller has proven by her actions that she has much to gain with all of her maneuvering in this. She screwed the Bell family out of their fifty-year family business, and now she wants to stick it to the tax payers.

Jason's entry also recounts the history of Jerry Gordon and the development of Jenks' Riverwalk Crossing. And in his most recent entry, he demolishes the PR spin from the Tulsa Metro Chamber on their economic impact numbers:

My first question was this: "Is it true that the current river development in Jenks, which is wildly popular and financially successful, was built with no tax increase at all?" Her answer: "Yes."

My second question: "Is it true that the majority of the 10,000 jobs she is speaking about are low paying construction jobs, which will only last until the low water dams are complete?" Her answer: "Yes."

My third question: "If Tulsa votes down this sales tax increase, is it true that the commercial developers will still be allowed to build shops, restaurants, and condos along the river?" Her answer: "Yes."

My fourth question: "Isn't it true that the George Kaiser Foundation has already donated $20 million to enhance trails in the Riverparks area, and that work has already begun on these developments?" Her answer: "Yes."

And then there's Jason's take on the media blitz in support of the tax:

Anytime the county and the news media have to engage in a smoke and mirrors game to make the public believe that this tax has the full support of the public, anytime a PR firm has to spend hundreds of thousands of dollars to use children to make you feel guilty if you vote against it, there is something wrong.

Cindy Downes, a 57-year-old empty nest mom who is going to college, attended the "debate" last week at TCC, and she had to write a paper on the event as a class assignment. It's a well-written, detailed report, and you should read the whole thing. Cindy says it wasn't really a fair fight:

They had four speakers: Winn Estrada, who was against the River project; Robert Nichols, who was supposedly impartial; and Victor Muse and Randi Miller who were for the project. Winn Estrada had 10-15 minutes. The rest of the time was taken by the other three, with the majority of the time used by Randi Miller.

Victor Muse, the student debater in favor of the tax cited the Three Gorges Dam project in China as a positive example of river development. In fact, Three Gorges is a classic example of totalitarian environmental overreach, damaging the environment, archaeological sites, matchless scenery, and ancient cities, displacing two million people and a way of live dependent on the ability to navigate the Yangtze River. It's an example of the damage a totalitarian government can cause because there is no place for opposition groups that might challenge the government's plans.

Cindy went on to report some classic Randi Miller moments:

I asked about the eagles and she stated that the project would not affect this eagle habitat. I then asked to hear from Winn exactly why he thought it would. She said she did not come to debate her "constituents;" however, note that her whole speech up to this point was a "debate" against her constituent. She did give him the microphone briefly, but she kept talking about not debating her constituent and he was not able to get the "floor" back to adequately answer the question.Someone then asked about the condition of the roads and why we should not fix them first. Her answer was that there is already $200M set aside for roads in Tulsa. There is some kind of "Bottleneck" that they are trying to figure out why this money is not getting used. They "think" it is because there are not enough companies in Oklahoma to do road repair and she encouraged the students to start a business in road repair as there is a definite need.

She ended with the statement that if this doesn't pass, it will be 20 years before it can come to the table again.

20 years? And has Mayor Taylor investigated this $200 million that Miller says is set aside for roads but isn't being spent?

You might think a blogger called CycleDog would be all for this tax plan, but no:

Some of the arguments in favor of the proposition have been downright silly. The latest was in today's newspaper, arguing that building a new park will attract droves of young people to area businesses, and these new folks will contribute so much money to the economy that the city will be able to rebuild our crumbling roads and road infrastructure. These people must have attended that same voodoo economic course as the Reagan administration.Don't misunderstand me - I'm not opposed to paying taxes when the money goes to something that provides real, tangible benefits. But when faced with a stark choice - a local school or a distant park - the right choice is very clear.

And commenter Ryan responded:

I have friends that have transplanted from San Diego, for the sole reason of being able to afford a new home, and even they never had to pay such a high sales tax to live in a city with sports stadiums and one of the nicest parks I've ever had the pleasure of visiting. I won't lie, I'm not an expert in city planning or budget, but I do know there's something wrong when this city can't develop without raising our sales tax to something that even ex-California residents scoff at.

Debb at Okie Mom Confessions confesses her reasons for a no vote on October 9th. She asks some great questions:

Vision 2025 addressed some of this already, the 2 low water dams & the shoreline beautification was to be addressed from funds from Vision 2025. Why are we, essentially paying for it yet again? Where did the money go?...

How successful will Glenpool, Skiatook, Collinsville, Broken Arrow, and Owasso be in financing their cities if the county has already pushed the taxpayers to the limit?

If we cannot already support what we have, how will we maintain an even larger expanse of parks & bridges, dams, etc., that will need a lot of costly spending for upkeep?...

MySpacer Ferdinandy gives his top 10 reasons for voting no, including:

6. CORPS of ENGINEERS APPROVAL: We don't even have approval to alter the river from the Corps yet. What happens if we vote to tax ourselves and the Corps of Engineers says "NO!" Do we get our money back?

8. COUNTY GOVERNMENTS SHOULDN'T BE IN SALES TAX BUSINESS: Sales tax is (in most responsible budgeting plans) used by cities to take care of city issues. When counties get in the sales tax business....well...there's just not enough to go around.

Some LiveJournal-ists are talking about tax. dividedjoy writes:

i don't even think they know what they want to do, all the ads and info just keep saying how badly we need this tax...but no good reasons of why besides it being for "Tulsa's future yay!!!"

part of it is that they want to build a series of low water dams - which have not been approved by the corp of engineers AND which the us fish and wildlife service says would very badly screw up the ecosystem in and around the river not just in tulsa, but up and downstream as well...they also want to build a pedestrian bridge down by 61st street...you know, by the stinky water treatment plant...

And lbangs has launched a river tax comment thread on the Tulsa Time LiveJournal community:

I'm all for smart city development, but gee, most of the studies commissioned to study this proposal will not even be finished by the time the vote comes to the public.I'm sorry, but that is plain idiotic.

Is it too much to ask for some intelligence in our planning? I'm seeing a lot of hype and hoopla, plenty of smoke and mirrors, and precious little facts or truth.

And just who exactly is paying for all these moronic television ads trying to make you feel like you hate cute little children if you vote against this potential city-wide folly?

Somebody with deep pockets has a lot to gain from this project.

But don't look now; it ain't you or me.

And now let's turn to some of our long-time blogpals:

Jeff Shaw is pondering the magic formula:

Underestimated costs + Overestimated benefits = Project approval

And he finds this nugget of wisdom in a report called How Optimism Bias and Strategic Misrepresentation Undermine Implementation:

Lawmakers, investors, and the public cannot trust information about costs, benefits, and risks of large infrastructure projects produced by promoters and planners of such projects.

More recently, Jeff is wondering about the latest wild claim of 10,000 new jobs if the river tax passes, and he puts that big number into perspective.

Steve Roemerman is wondering how a fiscally conservative congressman can endorse a tax increase, and he wonders whether the congressman had certain facts in front of him when he made his decision. Steve's readers have been pondering the same question, as have some of Jeff Shaw's readers.

"Mad Okie" uses Google Maps to illustrate the differences between the waterside developments in Indianapolis, San Antonio, and Oklahoma City and what's being proposed in Tulsa. Hint: Note the width of the relevant body of water. And he takes issue with an unnamed state rep, quoted in a KOTV story saying that the river plan "would bring more entertainment options for everyone."

The people of the North Side, West Side, East Side, and South side dont care about "entertainment options", especially when the people pushing these "entertainment options" are the same people that evicted BELLS, a real entertainment option!

Bobby at Tulsa Topics (back to blogging again!) has a similar concern:

Thanks to the same people who want you to give them more money via the upcoming River Tax vote.... you will not be seeing the Zingo or the rest of Bells at the state fair this year.

I find it ironic, the flagrant use of kids on all the hack ads that the vote yes camp has been running on the tube lately, when the same group killed a long standing family tradition here in Tulsa.

MeeCiteeWurkor has ideas on protecting your "No River Tax" sign from getting stolen, and a guest contributor has been following developments in Sand Springs, including the Sand Springs City Council's vote to endorse the tax hike.

Those are two questions about two major thrusts of the campaign for the proposed Tulsa County sales tax increase for river-related projects. In this week's column in Urban Tulsa Weekly, I ask whether this river tax plan is what we need to do for the sake of Tulsa's children and young adults.

In response to the first question, I deal in passing with one river tax cheerleader's active involvement in destroying a place of fun and happy memories for Tulsa's children, and pass along a suggestion, made by my wife, for how you could protest Bell's eviction from the Tulsa County Fairgrounds, should you decide not to boycott this year's Tulsa State Fair entirely:

In addition to the obvious -- don't spend money on the Murphy Brothers midway -- here's a homemade idea for those who go to the fair but wish to protest Bell's eviction: Wear bells to the fair. You can buy a big bag of jingles at a craft store for a few dollars. Thread a bunch on a ribbon to wear around your neck. Bring extras to give to friends or fellow fairgoers.

And if you want to make the point explicit, stick a nametag on your shirt with the slogan that's been spotted around town: "No Bell's. No fair."

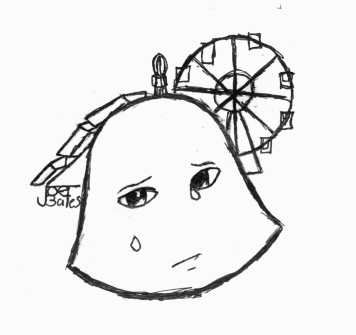

Accompanying that suggestion on page 7 of this week's UTW is the first published work by a budding young cartoonist named Joe Bates, depicting a weeping Bell. He's got some more political cartoons in the work. The demolition of Bell's is something my two older kids saw happening on an almost daily basis, and it saddened them both greatly. I'm proud to see my son express his sentiments so eloquently in art. He's already working on some more cartoons.

Accompanying that suggestion on page 7 of this week's UTW is the first published work by a budding young cartoonist named Joe Bates, depicting a weeping Bell. He's got some more political cartoons in the work. The demolition of Bell's is something my two older kids saw happening on an almost daily basis, and it saddened them both greatly. I'm proud to see my son express his sentiments so eloquently in art. He's already working on some more cartoons.

I mentioned in the column that skipping the fair entirely is hard for a lot of people from Tulsa and the northeastern Oklahoma. Going back to the '40s my great-grandmother and grandmother would enter the craft competitions, and in recent years my two older children have had fun submitting their own creations. Joe has won two blue ribbons, one in 2004 for an acrylic painting and one last year for a convertible built with Legos. Both he and his little sister plan to enter some items again this year. To us, and to a lot of families, the Tulsa State Fair was here before Randi Miller and Clark Brewster and Rick Bjorklund, and it'll be here when they've all moved on to other things. But I can certainly understand those who plan to abandon the fair altogether.

Regarding young professionals, in my column I mention a recent visit to Orlando and a Saturday evening spent on lively Orange Avenue, between Church Street and Washington Street in that city's downtown:

Downtown Orlando has shiny new skyscrapers, a basketball arena, and a beautiful 23-acre lake with a fountain. But I didn't find the crowds around any of those. There were only a few people walking the path around the lake, and the sidewalk along Central Boulevard next to the lake was empty except for me.

Instead, the throng of twenty-somethings was promenading up and down four blocks of Orange Avenue, a street lined with old one-, two-, and three-story commercial buildings. The storefronts of those buildings were in use as bars, cafes, and pizza joints. The same kind of development stretched for a block or two down each side street. There were hot dog stands on every corner. Pedicabs ferried people to and fro. The numbers of partiers only grew larger as the little hand swept past 12.

An observation from that visit that I didn't include in the column: The block of Orange between Pine and Church Streets has these old commercial buildings crowding the sidewalk on the west side and a spacious plaza framed by two modern, round, glass and steel buildings on the east side. Where do you suppose people chose to walk? 90% of the foot traffic stayed next to the old storefronts and avoided the big modern plaza.

As I mentioned in last week's Urban Tulsa Weekly, a few weeks ago I began my search for the source of the numbers being cited in defense of the need to raise taxes to build the two low-water dams and the Zink Lake modifications promised in Proposition No. 4 of the Vision 2025 sales tax.

The debate over this issue has two prongs:

(1) Did Tulsa County officials promise to build the dams during the Vision 2025 campaign? And did they promise that they'd have the money to build them even if Federal matching dollars weren't available? Despite word-parsing efforts by Commissioner Randi Miller and others, the clear answer to that question is yes, as I've demonstrated from the official ballot resolution, the official project map used during the campaign, and quotes from Commissioner Bob Dick and others during the campaign, and even after the campaign, when Federal funding was once again in doubt.

(2) Is there enough money in projected Vision 2025 revenues to cover the cost of the new dams and the Zink Lake modifications? County officials, citing numbers developed by John Piercey, the county's bond adviser, say that the answer is no. Based on revenue projections, remaining projects to be funded, and debt service, there isn't enough money, they say to fund the low water dams beyond the specific amounts listed in the resolution, much less fund any other project on this October's ballot.

That second point set me off on a search to find out for myself. I combed through the five big binders of monthly Vision 2025 reports in the fourth floor Government Documents department of the Central Library. (The most recent three binders are in the work room, so you need to ask at the reference desk if you want to see them.)

Having looked at the sales tax summaries and project summaries in the monthly reports, I had a simple mental model of how it all fit together. You had two pots of money: A pot of sales tax revenue and a pot of bond proceeds.

Sales tax receipts come into the sales tax revenue pot, and from that pot comes bond repayment (debt service: principal and interest) and cash expenditures (e.g., money to pay down the Oklahoma Aquarium debt, fees to PMg and attorneys).

The bond proceeds pot is fed by proceeds from revenue bond sales, and that money is spent on expenditures for most of the projects.

So what I wanted to know was this:

(1) How much money was in each pot as of, say, the end of the fiscal year on June 30, 2007?

(2) How much money was likely to be added to the sales tax pot between now and the last sales tax check in February 2017? (There's about a month and a half delay between collection and the resulting check from the Oklahoma Tax Commission back to the cities and counties.)

(3) Of the money in the sales tax pot, how much is committed to debt service, and what is the repayment schedule?

(4) Of the money in the sales tax pot, how much is budgeted but yet to be spent for projects and for overall program expenses, and what is the schedule for spending that money, and for which projects?

(5) Of the money in the bond pot, how much is budgeted but yet to be spent for projects and program expenses, and what is the schedule for spending that money, and for which projects?

I figured that, with all the talk about how we wouldn't have enough money to build the promised dams, that somebody must have all this worked out, at least on a year by year basis. If you had the answers to those five questions, you could make decisions about borrowing against future revenues or the likelihood of additional money that could be spent on a pay-as-you-go basis or possibly even reprioritizing the sequence in which the remaining projects (including the dam and Zink Lake projects) would be funded.

I wrote about my quest a few weeks ago:

I asked Kirby Crowe by phone if he had a copy of this plan. I'm not sure if I made my meaning clear, but I came away from the conversation with the impression that he did not have a copy of Piercey's financial plan.

I called Jim Smith, the County's fiscal officer, and asked if he had a copy of the financial plan. I thought he might, since his name is on the monthly memo in the Vision 2025 report listing tax receipts, the monthly wire transfer from the sales tax fund to the trustee, and the interest earnings on the sales tax trust account.

Smith said he didn't have the financial plan, but suggested I call John Piercey. Mr. Smith could tell me what the payment to the trustee would be for the next six months, at which point it would be recalculated, but couldn't tell me anything more about future expenses.

I called Capital West, and they gave me John Piercey's number. I called John, and he was very gracious. He said he'd e-mail it to me that evening or the following morning. He said something about recalculating based on more recent tax receipts. I'd really be happy seeing the most recent version, whatever he's been using as the basis for his statements about Vision 2025 surpluses.

That was a week ago Monday, the 20th. I gave him a reminder call on the 28th -- got his voicemail and left a message. Haven't heard back yet. I'm sure he's quite busy.

Can anyone suggest somewhere else I could find this information?

That was on August 30. Eight days later, on September 7, I left another message for Mr. Piercey. I also, on a whim, called County Commissioner Fred Perry's office to see if they have a copy of this rumored financial plan. The administrative assistant didn't know, but she took my message, and about an hour later, Commissioner Perry called me. (Part of that conversation found its way into the update to this entry about the Republican Women's Club's exclusion of the opposition from a discussion of the county river tax.)

Perry told me he would ask Piercey to get me the information, and not long after I heard from Piercey. The following Tuesday afternoon, September 11, he dropped the three-page Excel printout, entitled "Vision 2025 Financial Summary" by UTW's offices. (Clicking that link will open a PDF file, about 300 KB.)

Off and on over the following week, I crunched through Piercey's numbers covering the next nine and a half years and tried to fit them together with the numbers in the Vision 2025 reports covering the past three and a half years, trying to meld them together into a consistent set of answers to my questions.

Finally, I sent Piercey an e-mail, attaching a snapshot of the financial spreadsheet from the June 2007 Vision 2025 report:

John,

Thanks again for providing me with that spreadsheet printout last Tuesday. I'm still looking at it and trying to understand how your numbers line up with the ones I observed in the Vision 2025 monthly reports from PMg.

The most puzzling thing is the gap between previous years debt service numbers and the numbers in your projections. Attached is a photo of the Vision 2025 sales tax report from PMg's June 2007 Vision 2025 report, which includes all receipts and expenditures through the end of FY07. It shows the following amounts transferred to the bond trustee:

FY

Transferred to Bond Trustee

2004

15,213,697.60

2005

34,394,424.51

2006

33,402,757.79

2007

34,645,690.81

I take those numbers to represent what has been paid to debt service to date. So it's puzzling that for FY 2008 that the debt service jumps up to $46,977,024 plus $396,500 for Series 2006 B. Did the debt service payments just jump up at the end of FY 2007, or is something else on that PMg spreadsheet that should be included in debt service to date?

Put another way, what are your numbers for debt service through FY 2007?

(I'm also surprised that the debt service number doesn't tail off in 2017, since there are only eight months of revenue from the tax in FY 2017.)

Another apparent difference between PMg's numbers and yours: PMg shows, after May 2007, $45,362,099.18 in the sales tax trust fund, and in June all of it is transferred to a new cash projects trust account, in addition to about $2 million transferred to this cash projects trust account back in February. You show $39,093,695 as sales tax revenues held by County. I don't understand how those two numbers line up.

Another question has to do with when various expenses and funds might be realized. You show a balance to be funded of $104.5 million and about $69.3 million of cashflow from bond fund reserves ($39.4 million), net earnings on bond funds ($13.7 million), and net earnings on cash flow ($16.2 million). Has anyone mapped out, to the fiscal year, when these expenses and earnings will be realized?

Thanks again for your assistance,

Michael D. Bates

Here is Piercey's reply in full, clarifying the nature of his report and his role with Vision 2025 and Tulsa County:

Capital West Securities, Inc. official involvement with raising additional funds for Vision 2025 ended in the third quarter of 2006 with the completion of the funding of $31 million in parity and subordinate bonds which partially funded the $45.5 million approved by the County for the Arena and Convention Center. The balance of the funds for the projects increased budget will come from cash flow through the end of calendar year 2008.

My current involvement is as an unpaid monitor of the monthly sales tax receipts and the preparation of a semi annual update of the status of the financial condition of the program. The day to day management of the Program is performed by PMG and the funds administration is performed by the Bond Trustee in cooperation with Jim Smith, the County's fiscal officer. The summary that was given to you is the most current semi annual Update that I have done and is not a "financial plan".

The monthly PMG report provided to the elected officials and the Sales Tax Overview committee will differ from my evaluation simply because they are looking primarily at projects implementation and monthly cash flows provided to them by the Trustee and PMG. They will also differ as a result of the time frame that I used and the in and out of money that occurs weekly.

As I pointed out to John Eagleton in a prior correspondence, the debt service payments that are shown in the PMG reports are what the Trustee requires from sales tax receipts on a monthly basis. The difference between the receipts and the payment goes into sales tax trust fund. The sales tax trust fund is being used to fund Vision projects not funded by bond proceeds. It builds up over time as a results of primarily the City of Tulsa budget process which requires all funds to be in place and appropriated before project contracts can be signed.

The Trustee's debt service requirements given to the County differ from the debt service requirements on the bonds are a results of interest earnings on the construction funds held by the Trustee as well as interest earnings on the Bond Fund Reserve account of $39.09 million. Given the amount of proceeds raised early in the program those earnings were substantial in the early years of the program and decline as projects are completed. This will also be the case with the County's sales tax trust fund as the Arena and Convention Center is completed between now and the end of fiscal year 2008.

As for specific answers to your questions:

1. Debt service has risen annually since 2003 as a results of additional bond issues being done as projects became ready for implementation. Debt service has also risen as the amount of investment earnings have declined as moneys are spent.

2. The PMG debt service numbers are net of investment earnings.

3. All the bond issues, except series 2006B, are rated AAA. In order to get a AAA rating, a cash reserve of $39 plus million was funded early in the program and is held by the Trustee. The purpose of the reserve is have sufficient funds on hand to pay debt service in the event that sales tax receipts at any one time or length of time is insufficient to pay the debt service. The Reserve is released in the final year (2017) to pay most of the final year's debt service. This final payment assumes that no short fall has occurred.

4. The Series 2006 B bonds of $10 million are subordinate bonds and are unrated. The reason being that the requirements to issue more bonds on a parity basis could not be met. The $14.5 million in cash flow for the Arena and Convention Center was also the results of not being able to issue more debt without increasing the costs of the debt and the risk that other projects would have to be postponed or possibly eliminated if sales tax receipts declined.

5. The Vision 2025 program included $575 million in specific projects with specific dollar allocations. Of that total 83% were funded by bond proceeds or in the case the Aquarium annual payments were contracted for. The balance of approximately $100 million (excluding the rebate) are being funded by sales taxes and investment earnings remaining after debt service is paid monthly. With the exception of the River Projects which were matching funds, cash flow schedules have been reviewed and PMG schedules those projects as they become ready and/or funds are available.

6. As I have noted in the past, I see no excess funds being available for new projects or increases for approved projects until after 2012-13. I hope that my forecast is too low. The bulk of any future surplus will occur in 2017 as the $39.1 million in bond fund reserve is released.

John Piercey

There's a lot to digest here. I'm putting it all here for anyone who cares to analyze it and comment on it.

One of the discoveries in all this is that there are actually four pots of money. In addition to the bond proceeds and the sales tax receipts, there is a bond repayment trust fund held by the bond trustee (the Bank of Oklahoma). When Jim Smith tried to explain to me how it worked, I compared it to an escrow account for paying taxes and insurance on a mortgaged house, which Smith thought was a good analogy. The bond trustee then repays the bondholders from this trust fund. Every six months, the bond trustee recalculates the payments they need from Tulsa County's sales tax receipts to enable them to pay the bondholders.

Here's my paraphrase of Piercey's explanation of the difference between the payments to the bond trustee (found in the Vision 2025 monthly reports) and his schedule for repayment to the bondholders: The county began paying money into the bond fund as soon as the tax began to be collected, but well before they had to begin to repay the bonds. Those early funds earned interest, which reduced the amount the county had to pay to the bond trustee in order to keep the bond trustee's fund at the required level.

Without the details of the ins and outs of the fund being managed by the bond trustee, there doesn't seem to be any way to correlate the sales tax payments to the bond trustee (in the Vision 2025 monthly reports) with the payments to the bondholders (in Piercey's financial summary). The Vision 2025 monthly reports don't cover the balances and transactions in the bond repayment trust account or in the bond proceeds pot of money. (It just now occurs to me that those two pots may actually be a single pot of money.) There are individual monthly project expenditures in the report, which you can infer are payments from the bond proceeds, but it isn't explicit, and transactions like interest earnings are either not reported or perhaps just not obvious to me. It would be good to have a spreadsheet for the bond proceeds fund that spells things out as clearly as the sales tax spreadsheet does for that fund -- the balance at the beginning of each month, all the income and the outgo, and the balance at the end.

I mentioned that there's a fourth pot of money. The June 2007 Vision 2025 monthly report shows that in February, $2,093,676.40 was transferred to the Cash Projects Trust Account, and in June, $45,961,778.85 -- pretty much the entire sales tax reserve being held in the county's accounts -- was transferred to the Cash Projects Trust Account. A memo included in one of the monthly reports says that this account is also being managed by BOk.

I still don't see a way to answer my five questions from the information available. If I were a County Commissioner or a member of the Vision 2025 Sales Tax Overview Committee, I would insist on putting that information together and updating it on a monthly basis to serve as Tulsa County's financial plan for the Vision 2025 program.

It looks to me that John Piercey, PMg, and BOk each possess different pieces of the puzzle, but that no one has actually put all of it together into a complete picture, a complete plan that would permit exploring different scenarios that would allow the use of Vision 2025 funds to complete the dams that were promised as a part of that package.

There's another aspect of this that needs to be explored, but it's late and I'm tired. I'll just point you in the general direction. On the front page of Piercey's summary are three columns: "Pre-Request," "Arena Increase," "Revised Totals." The difference between the first and third columns tell quite a story.

From an email about the upcoming Republican Women's Club of Tulsa County's luncheon (Tuesday, September 11, 11:30 p.m., Holiday Inn Select, I-44 and Yale -- the old Hilton) (emphasis added:

Commissioner Perry will present the Proposed River Plan/Tax in an educational format. He will be aided by an engineer who played a key role in the development of the 42 mile River Corridor plan from which the proposed plan was derived.Commissioner Perry will present arguments which have been made both for and against the Proposed River Plan and the associated county sales tax to fund it. The matter is scheduled for a county wide vote on October 9th.

If you're a Republican woman and think it's egregiously unfair for a proponent of higher taxes to represent both sides of this debate (a debate where the county Republican party platform comes down solidly in opposition), you might politely encourage the RWC president, Nancy Rothman, to allow an actual opponent to argue the case for the opposition. (I won't reproduce her contact info here; if you're a club member, you have her phone number and email address in the meeting notice.)

UPDATE: I just spoke to Commissioner Perry, who wanted to emphasize that it was Ms. Rothman's choice, not his, to have him present both sides of the argument. He says he's going to have to walk quite a tight rope and that neither side is likely to be satisfied that their argument was fully presented. He also took issue to my characterization of him as a proponent of higher taxes, that there are things that make him uneasy about the river tax plan (the tax increase, Broken Arrow's opposition) and he's not cheerleading for it, but on balance he thinks it's good thing, and he is a proponent of letting the voters decide. He also pointed out that in the legislature he sometimes opposed sending an issue to a vote of the people: the lottery, casino gambling, certain tax increases.

Regarding the RWCTC event, Perry told me that Ms. Rothman is a professional mediator who feels that the Republican Party is too divided and contentious, so she didn't want to have a debate. I would think that, as a mediator, she would understand the importance of each side feeling that their concerns were fully aired and given a fair hearing. Perhaps her mediation sessions consist of her picking one side to argue both sides of a dispute.

To be fair to Ms. Rothman, there are political parties that do a much better job than Republicans of maintaining unity and harmony. For example, the Workers' Party of Korea presents a united front on every issue. You never hear a dissenting voice on any issue, or if you do, you never hear from it again. Perhaps she has the WPK in mind as a model for the Republican Party's future.