Tulsa County: May 2012 Archives

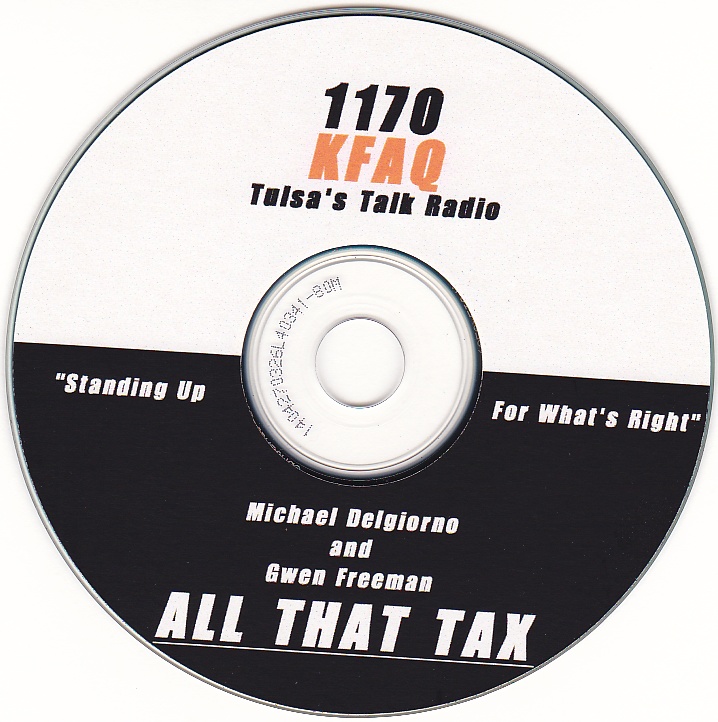

From the grooveyard of forgotten favorites, here's a song from the summer of 2003 and the run-up to the Vision 2025 sales tax vote, a parody of "All That Jazz," written and sung by then-KFAQ morning show sidekick Gwen Freeman, with patter from morning show host Michael DelGiorno. I came across it tonight while looking for something else, but it was a timely find; since an entirely new set of Tulsa County Commissioners is talking about increasing or extending the Vision 2025 sales tax, even though the original tax still has four more years to run. Click the picture to listen.

"Feasibility, schmeasibility! We don't need no stinkin' study!"

Just as they did in 2003, Tulsa "leaders" are preying on anxieties about job losses to justify siphoning more of your tax dollars through county government to favored businesses. Two possibilities are being discussed to raise $340 million: Either a county-wide sales tax increase of 0.4 percent or an extension of the Vision 2025 0.6 percent county sales tax beyond its December 31, 2016, expiration date. The proposal would include $260 million for airport infrastructure improvements and $80 million for a "close the deal fund" -- money we could throw at businesses to convince them to relocate to Tulsa. It all amounts to corporate welfare, with government picking winners and losers, rather than creating a favorable environment in which any business could flourish. (NOTE: More recent reports specify the number as $254 million for airport infrastructure improvements and $75 million for the slush fund, for a total of $329 million.)

The proposal is the wrong approach to economic development, the wrong method to finance it, and the wrong body to oversee it.

They're calling this idea "Vision for Jobs" but that's what Vision 2025 was supposed to be. In 2003, we were told that the Vision 2025 tax would fix our economy, in a slump after the tech and telecom crash of the early 2000s. Evidently, it didn't work, or they wouldn't be asking for more money now. Rather than allowing that $340 million to circulate freely in the local economy, rather than encouraging diversification of the economy, the civic leaders that brought us the Great Plains Airlines disaster want to put an even bigger bet on commercial aviation, a struggling sector of the national economy.

Our Republican County Commissioners ought to be pouring cold water on the idea. That they seem to be seriously entertaining it might lead a cynic to suspect this is a grab by Tulsa County officials to keep the money flowing through the Tulsa County Industrial Authority to its favored vendors -- bond attorneys, bond advisers, bond underwriters, program management firms, construction companies. Vision 2025 is coming to an end in 2016, and in order for the County Commissioners to continue to manage hundreds of millions of dollars, they urgently need to find another pretext for keeping the bucks flowing. American Airlines's Chapter 11 bankruptcy came along at a convenient time.

County Commission Chairman John Smaligo was on KFAQ's Pat Campbell Show Wednesday morning supporting the notion of a Vision 2025 sales tax extension.

Local government can't pull American Airlines out of bankruptcy. It's like trying to put out the sun with a squirt gun. The airline's problems are rooted in labor agreements made when times were fat and in a particular Clinton administration decision in 1993 that undermined AA's leverage to deal with excessive union demands. The airline's survival depends solely on its success in restructuring its costs with the cooperation of its creditors and its unions. Assuming it does survive, AA has a huge investment in buildings, equipment, and -- most importantly -- skilled personnel in Tulsa that it wouldn't be likely to abandon.

And if they decide to go, notwithstanding that investment, plus the state and local subsidies American Airlines has already received ($22.3 million from Vision 2025, plus state Quality Jobs Act tax credits, among others), no amount of additional subsidy will keep them here.

Wichita, Kansas, found that out earlier this year. The World Trade Organization identified $475.8 million dollars in subsidies from Wichita to Boeing, in addition to uncountable withholding tax exemptions, property tax exemptions, and sales tax exemptions. Kansas federal legislators expended a great deal of political capital to help Boeing land the contract to build the KC-46, the US Air Force's next generation aerial refueling tanker, with the expectation that Boeing would bring 7,500 new jobs to the state. For all that public assistance, Boeing announced in January that it was completely abandoning Wichita and Kansas, taking 2,100 jobs -- a net loss of nearly 10,000 jobs, not counting supplier jobs lost. (Here is the home page for the WTO case dealing with Boeing's subsidies.)

There's some question about how much of the proposed $340 million would even go to help American Airlines with its specific needs. News stories hint that some of the money would be used for Tulsa's World War II era Air Force Plant No. 3. And I haven't seen this mentioned in connection with the proposed tax, but I wouldn't be surprised if some of it is earmarked for the multimodal facility discussed earlier this year in connection with transferring city property around Gilcrease Museum to TU. And of course there's that $80 million in walking-around money.

That brings us to the matter of oversight. If past history is a guide, the revenues from a county sales tax would be run through the Tulsa County Industrial Authority, which would issue revenue bonds to finance projects. The TCIA is a trust created under state law whose board consists of the three County Commissioners. As a trust, the TCIA isn't bound by some of the legal strictures that apply to county government.

We ought to be very skeptical of giving more tax money to the TCIA to handle. Few local government bodies are less accountable to the public than the TCIA. They do not competitively bid their bond contracts. Vague agendas for the TCIA's meetings are posted online (here's the latest example), without detailed backup information; meeting minutes are not posted online. (Correction 2012/08/09: I am informed by Commissioner Fred Perry that meeting minutes are online. They're in a separate section of the website from the agendas. They are, however, as vague as the agendas.)

The TCIA lends tax-exempt bond money to private organizations -- over $679 million in outstanding conduit debt as of June 30, 2011 -- but you won't find a list of borrowers or repayment terms on the county's website. You will find, if you go to a bond rating site like moodys.com, that the TCIA has lent money to Saint Francis Health System (over $200 million), St John, Hillcrest, Holland Hall School, University of Tulsa, and a variety of private real estate development deals. The TCIA is able to lend money to private corporations on more favorable terms than the commercial market because the bonds they sell are tax-exempt.

(More links mentioning TCIA's lending to private entities: Summary of Standard and Poor's report on TCIA Saint Francis bonds and an EDGAR filing of an investment fund that has TCIA Saint Francis bonds in its portfolio.)

(Here is the Tulsa County 2011-2012 Budget Book and the Tulsa County Industrial Authority 2011 Audit. I couldn't find any specifics in these documents about the recipients of conduit loans, just the aggregate amount of conduit debt owed by TCIA.)

A couple of those real estate deals involved John Piercey, a close friend of then-County Commissioner Bob Dick, who also has served as the TCIA's bond adviser. The Tulsa World reported in 2002 that the TCIA lent Piercey's company $15 million to buy and rehabilitate several apartment complexes, then five years later lent an

out-of-state entity $30 million to buy and rehabilitate the same complexes from Piercey's company. Perhaps this sort of lending went away as that generation of county commissioners left office, but there's still not enough specific data online about the TCIA's operations to know. (CORRECTED: The time between the two transactions was five years, not 15 years.)

And speaking of transparency, it's a bad sign that, in his interview with Smaligo, Pat Campbell had to rely upon a leaked report provided by a source wishing to remain anonymous in order to know that a $40 million surplus was projected for the Vision 2025 sales tax. Shouldn't we be able to see projected revenues, outstanding debt and outstanding obligations at a glance on the official Tulsa County website?

In 2007, when I tried to find out the projected Vision 2025 surplus, and whether it might be sufficient to finance the Arkansas River dams promised as part of that package, I was shuffled from one county office to another only to find that no sworn county official had that information. Instead, the information was provided by the aforementioned Mr. Piercey, who was by then not under contract to the county, but described himself as an "unpaid monitor of the monthly sales tax receipts and the preparation of a semi annual update of the status of the financial condition of the program."

Campbell's interview with Smaligo contained another fascinating bit of information: When Tulsa was allocated, by the Tulsa County Vision Authority, $45.5 million extra to pay for the super-deluxe-iconic version of the arena, the other Tulsa County municipalities demanded and were promised the chance to split up any Vision 2025 surplus amongst themselves, since the arena was considered a project for the benefit only of the City of Tulsa. So effectively, the arena overrun cost Tulsa County taxpayers $85.5 million that could have been paid for the low-water dams promised as part of Vision 2025.

Tulsa International Airport is a city-owned facility. If it were appropriate to do anything with tax dollars to improve the airport, it should be done by the City of Tulsa and by its Tulsa Airport Improvements Trust, using revenues generated by airport tenants. Even then, such improvements ought to be of general benefit to current and future passengers, tenants, commercial and general aviation, and not specific to any business.

The proposed "Vision for Jobs" is the wrong tax under the wrong supervision to fund an outdated and discredited economic development strategy. I was heartened to read that polling showed the proposal likely to fail at the polls in November. Fiscal conservatives, opponents of crony capitalism, and opponents of regressive taxation should be able to join together to shut this down before it gets on a ballot.