Tulsa County: August 2012 Archives

Tulsa Mayor Dewey Bartlett Jr is holding the first in a series of Vision2 public forums tonight (August 27, 2012, Webster High School, 5:30 to 7:30 pm) to ask what projects should be funded with the money the county would <sarcasm>graciously</sarcasm> allow the city to have. Never mind that no public forums were held before the Tulsa County Commission decided to put the three-quarters-of-a-billion-dollars sales tax extension on the November ballot.

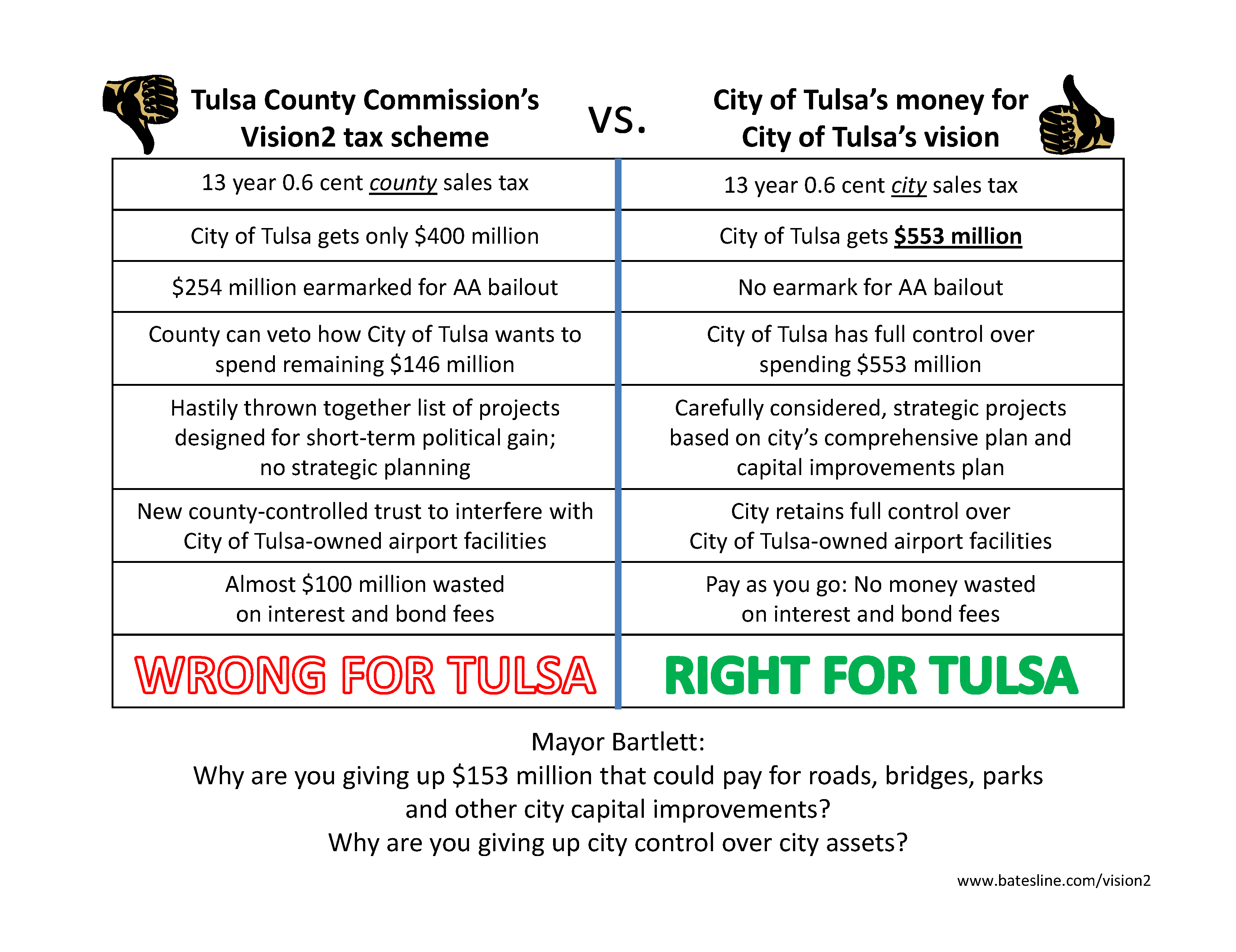

Tulsa voters should ask the mayor why any Tulsan should support a Tulsa County scheme that shorts our city $153 million in funds for roads, parks, and other capital projects, a scheme that gives another government body a say in city-owned airport properties, a scheme that gives the Tulsa County Commission veto power over the City of Tulsa's list of projects.

I've put together a simple chart (PDF format) comparing the Tulsa County Commission's Vision2 tax scheme with a plan that spends the City of Tulsa's money to implement the City of Tulsa's vision. You may find it helpful to print out and share with His Honor and His Honor's staffers this evening as you ask him why he's backing a plan that puts the City of Tulsa at such a significant disadvantage. (More here on the math behind the numbers on the chart -- why the City of Tulsa would be better off going it alone and taking over the Vision 2025 0.6 cent tax as a city tax when the Vision 2025 tax expires at the end of 2016.)

For your convenience, here is a list of the candidates I've endorsed, will be voting for, or otherwise recommend in the August 28, 2012, Oklahoma Republican runoff. Early voting is already underway; as this is a Federal election, early voting ("in-person absentee") began Friday and will be available at the Tulsa County Election Board at 555 N. Denver Ave in Tulsa on Monday, August 27, 2012, from 8 a.m. to 6 p.m. (All county election boards offer early voting at those times; click this link for your county election board's location.)

For your convenience, here is a list of the candidates I've endorsed, will be voting for, or otherwise recommend in the August 28, 2012, Oklahoma Republican runoff. Early voting is already underway; as this is a Federal election, early voting ("in-person absentee") began Friday and will be available at the Tulsa County Election Board at 555 N. Denver Ave in Tulsa on Monday, August 27, 2012, from 8 a.m. to 6 p.m. (All county election boards offer early voting at those times; click this link for your county election board's location.)

As I have time, I'll add links to endorsements I've already made, brief notes about those I haven't previously written about. Here's a link to the archive of BatesLine posts about Oklahoma Election 2012.

2nd Congressional District: George Faught: The only candidate with legislative experience, a track record of conservative leadership, and long-time residence in the district. Endorsed by major conservative groups and icons like Mike Huckabee, Phyllis Schlafly, David Barton of Wall Builders, Mike Farris, founder of the Home School Legal Defense Fund, Conservative Women for America PAC, Family Research Council Action PAC, Gun Owners of America PAC, and State Auditor Gary Jones. Faught's gaffe-prone opponent, Markwayne Mullin, has numerous political liabilities ripe for exploitation by the Democratic nominee. For example, Mullin claims to live in the 2nd district, but still claims a homestead exemption on a home in the 1st Congressional District. There's also the matter of the BATF raid on Mullin's business premises and questions about facilitating gun acquisition by a convicted felon in Mullin's employ. If Republicans are to have any hope of gaining this seat from the Democrats, we need a standard-bearer who won't stick his foot in his mouth, someone who has the knowledge and eloquence to explain to yellow-dog Little Dixie Democrats why the Republican Party best represents their values and concerns. George Faught, elected three times in a majority Democrat State House district, has what it takes.

Tulsa County Clerk: Dean Martin: Martin's central theme is greater transparency in county records. His opponent, the current deputy, seems satisfied with a public records system that requires monthly fees and the permission of the county commission for full online access. The Tulsa County Clerk's office needs new vision and direction, and that won't happen under a member of the current leadership team.

House 70: Shane Saunders: Shane's hands-on experience with the legislative process, his personal involvement with the oil and gas industry, his sharp mind, his devotion to his Christian faith and his family, and his affable nature will all be valuable assets not only to the citizens of House District 70, but to the majority Republican caucus and to the State of Oklahoma. Shane's also a new dad, married with a one-year-old daughter.

Disclosure: I do computer data processing work for the Saunders campaign.

This is pretty clever: A Tulsa County voter noticed that his signs supporting Dean Martin for Tulsa County Clerk kept disappearing from his yard. After losing several, he put a GPS tracker in one. It disappeared, too, but they found out who had the sign and a bunch of others besides:

When they followed the tracker, they were able to catch the campaign manager of Pat Key, Lee Alan Belmonte, on video stealing signs.They called Bixby Police who arrested Belmonte for knowingly concealing stolen property. Officers found more than 30 campaign signs in his vehicle.

Lee Alan Belmonte, a 59-year-old resident of Bixby, was arrested at 7:57 a.m. this morning by Bixby Police and was booked at 10:37 am at the David L. Moss Correctional Center.

Lee Alan Belmonte, a 59-year-old resident of Bixby, was arrested at 7:57 a.m. this morning by Bixby Police and was booked at 10:37 am at the David L. Moss Correctional Center.

A subsequent report from the Dean Martin campaign says that Belmonte isn't the campaign manager for Key, but he is a Pat Key volunteer and his wife works at the County Clerk's office:

We have received word from sources from the Key campaign that Lee Belmonte isn't the campaign manager. However, we have confirmed he is a volunteer. He claims to have 2 other crews helping him. And his wife works at the County Clerk's office under Pat Key. We know he has been paid in the past for putting up campaign signs. We don't know if he has been paid by Pat Key's campaign to do the same.You may say this isn't reflection of Pat Key. However, people have given her campaign descriptions of the vehicle and the person stealing the signs in the past 2 weeks. And to not shut Lee down immediately, when they had a description of the vehicle and a partial plate number, well that's for the voters to decide if Pat should be held accountable for Lee's criminal actions...

It's worth mentioning that there is no civil service protection for county employees. They serve at the will of the elected official. While I suspect that any newly elected official would retain most of the worker bees from the previous administration, someone in management may reasonably fear being replaced by someone close to the newly elected official -- strong motivation to help your boss get elected.

MORE: Here's video of more than 30 Dean Martin signs being unloaded from Belmonte's van by the Bixby Police:

Another race that will be decided in the August 28, 2012, runoff election is the race for Tulsa County Clerk. No Democrats filed for the open seat, and none of the three candidates received a majority in the June primary, so the runoff between the top two finishers -- Pat Key and Dean Martin -- will decide who will take over this important county post.

Although many people I respect are supporting Key, and although Key bought an ad on this site, I believe it is time for a change in leadership at the County Clerk's office, so I am endorsing Dean Martin for Tulsa County Clerk.

Although many people I respect are supporting Key, and although Key bought an ad on this site, I believe it is time for a change in leadership at the County Clerk's office, so I am endorsing Dean Martin for Tulsa County Clerk.

Key is the current chief deputy, running to succeed her boss, Earlene Wilson. Wilson was first elected in 2000 to succeed her boss, Joan Hastings. The County Clerk's job is keeping and providing access to public records, including deeds, contracts, agendas, and meeting minutes. As I wrote before the primary, the current County Clerk's office administration, in which Pat Key has been chief deputy, has dragged its feet in providing complete access to the public, and thus Tulsa County lags badly behind other jurisdictions:

The inconvenience of driving to the county courthouse to get complete information about property transactions is no accident, sadly. It's part of the philosophy of the incumbent, a philosophy I assume is shared by Key, the current deputy. The incumbent administration seems to see public access as a problem to be managed, not as an opportunity to serve the public interest. There's a stark difference between the openness and ease of access to be found on the Oklahoma County Clerk's website compared to what you find on the Tulsa County Clerk's website....Long-time readers will know that I've long been frustrated by the Earlene Wilson/Pat Key administration's foot-dragging on public disclosure. (Here's a complaint from 2004, a response to a March 2009 Journal Record column by Ted Streuli titled "Tulsa County Clerk Earlene Wilson is picking your pocket," and a concern raised this year when Pat Key might not draw an opponent.) Pat Key was Wilson's deputy throughout Wilson's tenure as County Clerk and never raised a public objection, as far as I've found, to Wilson's access-thwarting policies.

Pat Key seems like a decent person and by all accounts a competent manager. It might be very wise for Dean Martin to keep her on as chief deputy if she were willing to stay. But competent management is not enough when an organization isn't moving in the right direction.

The County Clerk's office needs a new direction, a new guiding vision, a change from the leadership of the last twenty years, which seems stuck in the pre-World Wide Web era. I believe that Dean Martin can bring that kind of leadership to the County Clerk's office.

Dean Martin is a lifelong Tulsan, a graduate of Will Rogers High School and Oklahooma State University. Martin has over 30 years of business experience, including the recruitment, training, and management of personnel. He has been endorsed by County Assessor Ken Yazel, former State Senator Randy Brogdon, and former TU football coach and Tulsa County Republican Vice Chairman Dave Rader.

As Tulsa County Clerk, Dean Martin will also give taxpayers another strong advocate for their interests and public transparency on the Tulsa County Budget Board. The County Clerk is one of eight members of the budget board. Right now, only one member of that budget board believes that all county revenues and expendtitures, including those of authorities and trusts, should be included in the county budget. Dean Martin agrees with County Assessor Ken Yazel that the budget should cover all sources of revenue and all county expenditures. Pat Key's boss didn't support that idea in the budget board meeting this year, and Pat Key hasn't expressed any disagreement with her boss on that point.

I'm also pleased that Dean Martin has come out in opposition to the idiotic Vision2 proposal -- the tax, AA corporate welfare, and pork barrel package put forward by the County Commission for November's ballot. Many elected officials may think Vision2 is poorly thought out, but few will have the courage to speak out against it. Hundreds of thousands of dollars will back the vote yes side, much of it from people and companies who stand to make a pile of money if it passes. It's a big help for the opposition when elected officials are willing to speak out against an ill-considered tax, borrow, and spend plan like Vision2. Pat Key has not taken a public stand on the issue.

Dean Martin's vision for greater access and transparency has already encouraged some positive changes in the county clerk's office. The office used to close over lunch hour, and Dean Martin said that as clerk he would have workers stagger their lunch breaks so that the office could remain open. Since so much information is only available by going to the office in person, it's important to keep the office open when people with regular jobs have the opportunity to visit. Sometime recently, this policy was implemented.

Pat Key's campaign has made much Tulsa County's A+ rating from Sunshine Review. As someone who uses government websites to research what I write here, I've always been baffled by that A+, as so much of the information I seek has not been available online. The website's disclaimer page may explain the gap between perception and reality (emphasis added):

Sunshine Review is an online open-content collaborative encyclopedia, that is, a voluntary association of individuals and groups working to develop a common resource of human knowledge. The structure of the project allows anyone with an Internet connection to alter its content. Please be advised that nothing found here has necessarily been reviewed by people with the expertise required to provide you with complete, accurate or reliable information.That is not to say that you will not find valuable and accurate information in Sunshine Review; much of the time you will. However, Sunshine Review cannot guarantee the validity of the information found here. The content of any given article may recently have been changed, vandalized or altered by someone whose opinion does not correspond with the state of knowledge in the relevant fields.

That means it's entirely possible for a Tulsa County employee to have rated the county's website and given it an A+.

As I look at the criteria by which county records are supposed to be graded, it seems to me the county deserves an "incomplete" in most categories. For example, I don't see a checkbook register or credit card receipts posted online, a requirement listed in the budget category. Minutes of past meetings are there for some boards and authorities, but not all.

Some contracts are posted, but many appear to be missing -- e.g. any contracts for the Tulsa County Industrial Authority (TCIA), the Tulsa County Public Facilities Authority (TCPFA, aka the Fair Board) contract for the Tulsa State Fair midway, the TCPFA lease agreement for Big Splash, the County Treasurer's contract with the office's outside legal counsel -- and others are missing appendices and attachments -- e.g. the Arabian Horse Show contract. Sunshine Review says that a vendor's campaign contributions should be posted with the contract, but I don't see any campaign contribution info on the website at all.

With incompletes in at least five of 10 categories, Tulsa County's website should have a C at best from Sunshine Review. While there have been some recent improvements -- making it easier to find minutes from the agendas, hotlinking agenda items to backup information, both at least partly as a result of my feedback -- it is not an A+ site, and it's a ridiculous boast to claim that it is. There is plenty of room for improvement, as you can see by comparison to the county website that the Sunshine Review criteria list points to as a paragon of transparency: Anderson Co., South Carolina.

It's time for an honest assessment of Tulsa County's efforts to gather, preserve, and make government information public, in an age when "public" means "online." We need an honest grade, not grade inflation, and a concrete plan for improvement. I see no reason to believe that someone from the current administration would depart from the current administration's foot dragging.

The Tulsa County Clerk's office needs new leadership devoted to convenient and complete public access to public information. Dean Martin has that aim as his vision, and that's why I'm voting for Dean Martin for Tulsa County Clerk.

I've been told that my name has been mentioned in connection with the decision of the Tulsa County Republican Party County Committee to censure County Commissioners John Smaligo and Fred Perry for their vote to put the Vision2 sales tax on the ballot for November. For the moment, a few disconnected thoughts will have to suffice:

1. I attended the meeting as a precinct chairman and thus as a member of the County Committee, not as a blogger or member of the media. This is why I didn't live-blog or live-tweet the proceedings and haven't written about what individuals said during debate or how they voted. A county committee meeting is not the kind of semi-public event that a party convention is. The press wasn't invited to attend.

2. I was asked by Vice Chairman Mike McCutchin to hold off on publishing anything about the resolution and the censure until the chairman issued an official press release, and I have done so.

3. There was unanimity in opposition to the Vision2 proposal. The debate was over what should be said in a resolution. I argued against one proposal (brought forward by Greg Hill, not "Gary Hill" as the Whirled story had it), which would have incorporated my blog entry that compared Vision2 to President Obama's policies. I argued that language appropriate to an individual expressing his own opinion might not be appropriate to a statement coming from the party as a body. Someone else pointed out that liberal Democrats have often joined conservative Republicans in opposing local sales tax increases, and the term ObamaVision may give unnecessary offense and hinder an alliance to defeat the tax. Greg Hill's proposal was never actually moved for consideration (another error in the Whirled story; to move things along, I moved for adoption of Ronda Vuillemont-Smith's shorter, simpler resolution.

4. Support for censure was overwhelming; there were only three votes against. The topic came up during the debate over the resolution opposing Vision2, and after some back and forth there was a consensus that any censure should be a separate matter, not part of the resolution addressing Vision2.

5. Yes, I made the motion for censure, but I wouldn't have bothered had there not already been a strong consensus in support of the idea, as voiced during the debate on the resolution. I don't recall there being much debate on censure -- people were either for it or against it. I certainly didn't have to twist any arms.

6. Putting a tax on the ballot is not a neutral act, as Commissioners Smaligo and Perry would like you to believe. I don't recall either of them ever putting forward a ballot measure to cut TCC's millage rate or end the Vision 2025 sales tax as soon as sufficient reserves exist to meet all outstanding obligations, although both ideas are worthy of discussion. They haven't given us a choice between spending three-quarters of a billion dollars on Vision2 vs. a short-term G. O. bond issue to, say, rebuild the levees. No, they picked one particular proposal -- a particularly bad proposal, vague, hastily assembled, and packed with corporate welfare and pork barrel, heavy laden with interest and fees -- to put before voters, and they blocked any alternative from coming before us. They've only given us a yes or no option. They have therefore endorsed this proposal by putting it on the ballot.

7. Furthermore -- and this is what makes their vote particularly deserving of censure -- this is now the second time that they have forced the grassroots fiscal conservative Republicans who got them elected to spend their personal time and treasure trying to counter a "vote yes" campaign with hundreds of thousands of dollars to spend on ads and consultants.

I remember primary runoff night in 2006, standing in Fred Perry's living room and looking around at all the conservative activists who had volunteered for Fred. These same people had worked hard to defeat previous tax increases, and they supported Fred for County Commission because they believed he was a limited-government, low-tax, free market conservative who would fight to reign in the growth of county government and oppose new taxes.

Instead, Perry and Smaligo voted to put the river tax on the ballot -- a flawed plan that would have raised the overall rate of sales tax. (Yes, Mr. Smaligo, you have indeed voted for a tax increase.) I suspect at least 90% of the people in that room that night would now express disappointment with Fred Perry, and I suspect that many of John Smaligo's supporters from 2006 feel the same way. Now they've put a second tax on the ballot, and for conservative Republicans it's another slap in the face. Once may be forgivable; twice is not.

8. This Republican county platform took a clear stand in opposition to renewing the Four to Fix the County sales tax. No one dreamed that they'd come after Vision 2025 renewal more than four years before it's set to expire, or I'm certain that a plank opposing Vision 2025 extension would have passed overwhelmingly.

9. To those who think the parties should remain silent on this issue, I agree that this isn't a Republican v. Democrat issue. But the Vision2 proposal violates Republican free market and limited-government principles which are clearly outlined in the party platform, so it's appropriate for Republican activist leaders to oppose it on principle. We don't approve of stimulus packages and bailouts at the Federal level; why should support them on a local level? Liberal Democrats may also conclude that the proposal violates some of their key principles -- for example, the use of a regressive sales tax to funnel money to politically connected companies should be anathema to consistent liberals and conservatives alike, if for somewhat different reasons. I would hope that consistent progressive Democrats would push their party to take a stand opposing Vision2 as well.

10. To the Whirled commenter who accuses me of hypocrisy: I left that company seven years ago for better opportunities, long before Broken Arrow offered to help fund their new facility. I don't live in that city, so I'll leave it to the people of Broken Arrow to judge whether this was an appropriate use of tax dollars.

A possible response to my earlier entry, Vision2 share vs. Tulsa County municipality population, is that it doesn't count the money in Proposition 1 to improve city-owned facilities and to provide "equipment and fixtures and other capital improvements" for businesses in the "Airport Industrial Complex" as part of Tulsa's share.

Even if that were a wise way to spend $254 million -- and it's not -- the City of Tulsa and its citizens would be far better off financially if the City opposed the Vision2 county tax and raised the city sales tax by the same amount.

There's precedent for the idea: Way back in 2008, when we were debating different approaches to fixing our streets, Councilor Bill Martinson proposed that the city take over county sales tax streams as they expired -- adding two-twelfths of a cent when the County's "4 to Fix the County, Part II" tax expired in 2011, and adding 0.6% when the County's Vision 2025 tax expired at the end of 2016. The overall sales tax would remain the same at 8.517%, but most of the county's share would be shifted to pay for city capital improvements that directly affect our quality of life. The plan ultimately adopted by the City Council and the voters captured the "4 to Fix" 2/12ths, but left the Vision 2025 tax untouched.

Over the last 12 months, the City of Tulsa has collected about $71 million per penny of sales tax revenue. Over 13 years at that level of sales tax collection, the 0.6% sales tax under discussion would generate $553.8 million in revenue for the City of Tulsa. Deduct the $254 million AA bailout from that number, and there'd still be almost $300 million that the City of Tulsa could spend on the priorities in its capital improvements process. Better still, that money would be spent under the tighter competitive bidding laws that apply to the city and the city's more transparent approach to picking projects for capital improvements sales tax packages, a process that has its roots in the Inhofe mayoralty and the original 3rd Penny.

So under the Vision2 plan adopted by the Tulsa County Board of Commissioners, the City of Tulsa would get a $400 million share -- if you count the American Airlines bailout in that amount. If instead the City of Tulsa adopted its own 0.6%, 13 year sales tax, the City of Tulsa would get $553.8 million. For the same overall sales tax level, City of Tulsa would be better off by $153.8 million, a nearly 40% increase in money available for capital improvements.

I can't imagine any rational, honest reason for any City of Tulsa official to go along with Tulsa County's sales tax scheme.

AND ANOTHER THING: Under the Tulsa County Vision2 scheme, the City of Tulsa has to get the County Commission's approval on how the city spends it's share of the Proposition 2 municipal pork barrel bribery fund.

Projects shall be identified by the governing body of each Political Subdivision following public hearing and input of public comment, in such form and process as determined by such governing body, and shall be submitted to the Board of County Commissioners of Tulsa County, Oklahoma to determine whether the sales tax collected pursuant to this Resolution may be properly expended for such Project.

The table below compares each Tulsa County municipality's share of the proposed Proposition 2 sales tax -- 0.29% for 13 years -- with the municipality's share of Tulsa County's population. The figures, from the 2010 U. S. Census, include only the population of each city within Tulsa County (all but three of Tulsa County's municipalities overlap into surrounding counties). The population figure for Tulsa County is for the area of the county not within any municipality -- it's a pretty small percentage.

If you're wondering about Sapulpa: The seat of Creek County annexed the area along I-44 just east of the eastern terminus of the Turner Turnpike. Not many people live there, but there are stores, fast food restaurants, and motels. So Sapulpa gets the city sales tax for the retail development at Tulsa's western gateway.

| Political Subdivision | Percentage of Sales Tax Political Subdivision Allocated to Projects of Political Subdivision | Percentage of Tulsa County Population |

| Tulsa County* | 28.74% | 5.77% |

| City of Tulsa | 43.63% | 63.91% |

| City of Bixby | 3.13% | 3.43% |

| City of Broken Arrow | 12.19% | 13.36% |

| City of Collinsville | 0.85% | 0.93% |

| City of Glenpool | 1.63% | 1.79% |

| City of Jenks | 2.56% | 2.80% |

| City of Owasso | 3.98% | 4.36% |

| City of Sand Springs | 2.79% | 3.07% |

| Town of Skiatook | 0.32% | 0.35% |

| Town of Sperry | 0.18% | 0.20% |

| Liberty, Sapulpa, Mannford, Lotsee |

0.00% |

0.03% |

| Total | 100.00% | 100.00% |

The Tulsa County Board of Commissioners voted unanimously Monday morning, to the disappointment of many and the surprise of none, to put a 13-year sales tax extension on the ballot this coming November, more than four years before the tax is scheduled to expire. The package is being called Vision2 by its supporters. I call it ObamaVision for reasons described in a previous entry. The tax plan is a sort of Keynesian stimulus, much like the Obama stimulus package, borrowing today against future revenues to spend now.

The proposed taxes will last for 13 years without any provision for early termination. They will go into effect just as the Vision 2025 taxes expire at midnight on December 31, 2016 - January 1, 2017. Note that the resolutions leave certain expenses undefined, such as the amount of revenue that will pay debt service and bond fees, the amount of money in the Economic Development Slush Fund. The current Vision 2025 sales tax fund has raised an average of $53,426,185.35 per year over the first eight years of collections. Assuming no growth, Vision2 Proposition 1 would raise about $359 million, leaving over $100 million for debt service and Slush Fund. Proposition 2, the strings-attached bribe fund for the municipalities would raise about $335 million, again assuming no growth.

Tulsa would be a donor city under the scheme. Based on the last 12 months of tax revenue, the City of Tulsa collects a little over $71 million for each penny of sales tax. If the City of Tulsa were to impose its own 0.29% tax, it would collect about $268 million over 13 years. Under the county tax scheme, the City of Tulsa would only receive about $146 million (43.63% of $335 million), about 54% of what it could collect on its own at the same tax rate over the same period.

Below are direct links to the ballot resolutions on the county website. The ballot resolutions define the language that will appear on the ballot and any constraints on how the taxes received can be spent. While much of the text of the resolutions is boilerplate, Section 1 defines what will appear on the ballot, Section 4 defines the amount of tax increase, Section 5 defines the period for collecting the tax, Section 6 defines the rebate, and Section 8 defines how the money is to be spent.

Ballot Resolution for Vision2 Proposition No. 1: American Airlines Bailout, Economic Development Slush Fund

Ballot Resolution for Vision2 Proposition No. 2: Bribes for the cities (with strings attached)

And here is a summary of each, with the text of Section 8:

Proposition No. 1:

0.310% sales tax, collected 1/1/2017 - 12/31/2029 for "promoting economic development within Tulsa County, Oklahoma."

Section 8. It is hereby declared to be the purpose of this Resolution to provide revenue for the purpose of promoting economic development within Tulsa County, Oklahoma, and/or to be applied or pledged toward the payment of principal and interest on any indebtedness, including refunding indebtedness, incurred by or on behalf of Tulsa County for such purpose, including the following projects:Acquiring, constructing, improving or rehabilitating installations, buildings, improvements and infrastructure and other capital improvements to be owned by Tulsa County, Oklahoma, or the City of Tulsa, Oklahoma or a public trust or trusts formed for the benefit of either or both, for use by industrial or commercial concerns on locations in and around the Tulsa International Airport Industrial Complex.

Not to exceed $122,000,000.00Acquiring, delivering and installing of equipment and fixtures and other capital improvements to be owned by Tulsa County, Oklahoma, or the City of Tulsa, Oklahoma or a public trust or trusts formed for the benefit of either or both, for use by industrial or commercial concerns on locations in and around the Tulsa International Airport Industrial Complex.

Not to exceed $132,000,000.00All sales tax revenues in excess of the amounts necessary to complete the above listed projects (not to exceed $254,000,000.00 in total) plus any advance funding costs associated therewith shall be used to fund land, buildings, infrastructure and other capital improvements for the purpose of promoting economic development within Tulsa County, Oklahoma, including funding job creation programs, as determined by a public trust having Tulsa County, Oklahoma, the City of Tulsa, Oklahoma, the City of Bixby, Oklahoma, the City of Broken Arrow, Oklahoma, the City of Collinsville, Oklahoma, the City of Glenpool, Oklahoma, the City of Jenks, Oklahoma, the City of Owasso, Oklahoma, the City of Sand Springs, Oklahoma, the Town of Skiatook, Oklahoma and the Town of Sperry, Oklahoma, as its beneficiaries. Such public trust shall have seven trustees consisting of, ex-officio, the three members of the governing body of Tulsa County, Oklahoma, and the Mayor of the City of Tulsa, Oklahoma, and three members each of whom shall be at the time of appointment the Mayor of a municipality, other than the City of Tulsa, Oklahoma, located in whole or in part in Tulsa County, Oklahoma, appointed by the presiding officer of the governing body of Tulsa County, Oklahoma, and confirmed by a majority of the persons who constitute the governing body of Tulsa County, Oklahoma. In the expenditure of all funds hereunder, preference shall be given to local vendors and contractors to the extent permitted by law. In addition, such public trust shall approve any deletion or addition of projects from those listed above and any major change in scope, following a public hearing by such trust.

Proposition No. 2:

0.290% sales tax, collected 1/1/2017 - 12/31/2029 for "purpose of acquiring, constructing, furnishing and equipping capital improvements to be owned by Tulsa County, Oklahoma, incorporated municipalities located in whole or in part within Tulsa County, Oklahoma, or the State of Oklahoma or any instrumentality thereof."

Section 8. It is hereby declared to be the purpose of this Resolution to provide revenue for the purpose of, acquiring, constructing, furnishing and equipping capital improvements to be owned by Tulsa County, Oklahoma, incorporated municipalities located in whole or in part within Tulsa County, Oklahoma, or the State of Oklahoma or any instrumentality thereof, and/or to be applied or pledged toward the payment of principal and interest on any indebtedness, including refunding indebtedness, incurred by or on behalf of Tulsa County or incorporated municipalities located in whole or in part within Tulsa County, Oklahoma for such purpose. All sales tax revenues received shall be used for such purpose, as determined by the following provisions:"Capital Improvements" as used herein shall mean all items and articles, either new or replacements, not consumed with use but only diminished in value with prolonged use, including but not limited to, the purchase, lease or rental of machinery, equipment, traffic control devices and street lighting systems, furniture and fixtures; the acquisition of all real properties; the construction, reconstruction and repair of buildings, appurtenances and improvements to real property; the construction, reconstruction and repair of roads, highways, streets, alleys, overpasses, underpasses, bridges, trails, sidewalks, and other public ways, including the acquisition of rights-of-way and other real property necessary for such construction; the construction, reconstruction and repair of water systems and facilities, sanitary and storm sewer systems and facilities, drainage improvements, data transmission or processing systems and facilities, and communications systems and facilities, including the acquisition of rights-of-way and other real property necessary for such construction; the costs and expenses related to the aforesaid including, design, engineering, architectural, real property or legal fees.

Sales taxes actually collected shall be used for projects for Tulsa County, Oklahoma, the City of Tulsa, Oklahoma, the City of Bixby, Oklahoma, the City of Broken Arrow, Oklahoma, the City of Collinsville, Oklahoma, the City of Glenpool, Oklahoma, the City of Jenks, Oklahoma, the City of Owasso, Oklahoma, the City of Sand Springs, Oklahoma, the Town of Skiatook, Oklahoma and the Town of Sperry, Oklahoma (collectively the "Political Subdivisions") based upon the following percentages of sales tax actually collected:

Political Subdivision Percentage of Sales Tax Political Subdivision Allocated to Projects of Political Subdivision Tulsa County 28.74% City of Tulsa 43.63% City of Bixby 3.13% City of Broken Arrow 12.19% City of Collinsville .85% City of Glenpool 1.63% City of Jenks 2.56% City of Owasso 3.98% City of Sand Springs 2.79% Town of Skiatook .32% Town of Sperry .18% Total 100.00%

Projects shall be identified by the governing body of each Political Subdivision following public hearing and input of public comment, in such form and process as determined by such governing body, and shall be submitted to the Board of County Commissioners of Tulsa County, Oklahoma to determine whether the sales tax collected pursuant to this Resolution may be properly expended for such Project. Any advance funding costs associated with funding a Project prior to the date a sufficient amount of sales taxes is collected for such Project shall be paid by the Political Subdivision from other funds, or shall be paid from such Political Subdivision's allocation of sales tax in such amounts and proportions as determined by the Board of County Commissioners of Tulsa County, Oklahoma.