Tulsa County: October 2012 Archives

I was interviewed midday Tuesday by Fox 23's Ian Silver about the fundraising gap between the proponents and opponents of Vision2.

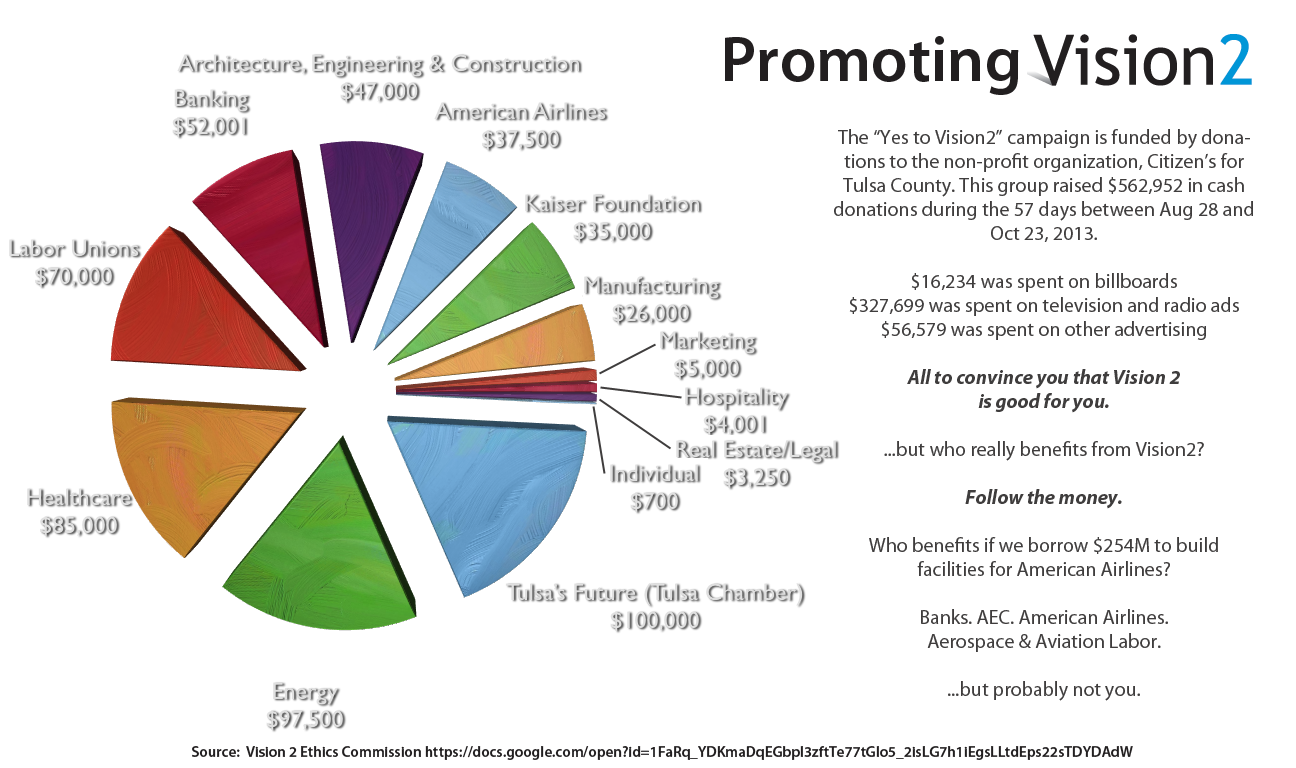

The "vote yes" bunch reports donations of $562,952, and only $450 in contributions of $200 or less.

The opposition group Citizens for a Better Vision has had monetary contributions of $3,859.69, of which only $2,459.69 was in amounts of $200 or less, and has spent $2,977.44, mainly on signs and bumper stickers. Individuals have independently and directly spent money on things like buttons and Facebook ads. (For example, I paid for color copies of my "Better Vision for Tulsa" handout, so I could have something to distribute at the Leadership Tulsa luncheon.) Even with these independent expenditures, opposition spending that we know of is about $10,000.

A ratio of at least 50:1 is not at all surprising. Giving on previous tax proposals has been similarly lopsided. It can be explained by public choice theory -- concentrated benefits vs. diffuse costs. Those businesses who stand to make millions, perhaps hundreds of millions, of dollars if this tax passes have a strong incentive to invest tens of thousands of their own dollars in convincing the public to approve it. Because the tax is broad-based, there's no concentrated benefit if the tax fails, so no one has the same financial incentive to give tens of thousands of dollars to the "vote no" campaign. As I told Fox23's Silver:

The opposition, he said, is made up mostly of individuals digging into their own pockets, and using social media to spread the word."It's all grassroots," he said. "It's all individuals digging into their own savings, their own fun money to do something they think is important for the community."

Matt Galloway has put together a very helpful pie chart, grouping contributions to the Vision2 "vote yes" campaign by industry (click to embiggen):

The Fox23 report was well done, but I need to correct a couple of things:

The story makes a reference to the "Vision 2025 bond package." It may be a losing battle to insist upon the distinction between sales tax votes and general obligation bond issue votes, but "here I stand; I can do no other." The Vision 2025 election was a collection of four sales taxes, one of which never went into effect. The other three sales taxes, totaling 0.6%, went into effect on January 1, 2004, and will run until December 31, 2016. The Tulsa County Commission assigned the revenue stream to the Tulsa County Industrial Authority, then they put on their TCIA hats and borrowed money against these expected sales tax revenues by issuing revenue bonds, but the voters didn't directly vote to issue bonds. "Bond package" or "bond issue," in reference to an election, should be reserved to refer to "general obligation bond issues," in which voters authorize borrowing money for a specific project (bonds) to be repaid by an increase in property tax millage (the general obligation).

Silver says in the story:

Businesses like Bank of Oklahoma and Manhattan Construction Co. could make a lot of money off Vision2 projects, but the county will have to put all contracts for Vision2 projects out to bid. The county can't just award contracts to companies that donated the most.

If the Tulsa County Board of Commissioners are under such a restriction, there are ways around it. The Tulsa County Industrial Authority (whose board members are the three county commissioners) can waive competitive bidding on bond underwriting with the approval of two of the three commissioners. About a month after Vision 2025 was approved by the voters, the TCIA board granted sole-source contracts to two financial companies to handle bond underwriting, two law firms to provide bond attorney services, and the company that would handle program management for the tax package. Professional services, as I understand it, are also exempt from competitive bidding. (Can't find the reference right now.) And with the appropriate findings of an emergency, competitive bidding may even be waived on construction projects.

I've been negligent. I did tweet about this brilliant video by Steven Roemerman, but had yet to post it here. Steven tried to call all three Tulsa County commissioners to invite them to speak to a neighborhood meeting on January 2, 2017, the day after the Vision2 tax will go into effect. He spoke to Fred Perry's assistant and to Commissioner Karen Keith.

Best quote goes to Commissioner Keith: "I think you better call back closer to that date, make sure I'm still alive."

So this tax that we'll be voting on in eight days was put on the ballot by one commissioner who will have been out of office for two years when the tax goes into effect and another commissioner who isn't sure if she'll survive until then.

In a recent issue of Urban Tulsa Weekly, Terry Simonson, who left his position as Mayor Dewey Bartlett Jr's chief of staff under an ethical cloud, makes a very weak case for de-annexing the Tulsa County Fairgrounds (aka Expo Square) from the City of Tulsa.

Over the history of the Fairgrounds' existence at their current location, various portions have been inside and outside the city limits. In 2007, the City Council voted to annex all 230-some acres of it, to be effective in January 2009. The delay was the result of a deal between then-Mayor Kathy Taylor and the county commission. County commissioners, who double as members of the Tulsa County Public Facilities Authority (TCPFA, aka the Fair Board), warned of dire consequences to the prosperity of Expo Square and the city if the annexation went through. Because the City surrounded the unincorporated territory on all four sides, it did not need the consent of the owner -- Tulsa County -- to complete the annexation.

(Note that Simonson neglects to inform the readers that three of the TCPFA trustees are the county commissioners, and the other two members are appointed by the county commissioners.)

As Simonson himself acknowledges, the years since annexation have been good years for Expo Square. The Tulsa State Fair has "come out ahead" the last three years -- all three years the fairgrounds have been completely within the city limits. The Arabian Horse Show renewed its contract through 2017. Gun shows continue to draw big crowds.

Having to collect city sales tax and comply with city regulations hasn't hurt Expo Square's ability to attract trade shows, horse shows, and other special events, and it hasn't hurt the Tulsa State Fair.

Despite the success Expo Square has enjoyed during its time within the city limits, Simonson calls for its deannexation:

Because Expo Square tries to operate free of intrusive government regulations and politics, it's time to turn back the clock and for the city council to de annex the fairgrounds. Some will remember that in an ill-fated and short-sighted attempt to shore up its own failing financial picture, the city believed in 2009 that if it imposed the city's sales tax on sales at the fairgrounds, and charge the fairgrounds city utility rates, it would be a tremendous financial windfall. It was never going to be, and it hasn't proven to be. Instead, Expo now spends over $148,000 on utility charges it didn't have to pay, has to deal with the inspection, permitting, and other city government red tape regulations.

I don't like intrusive regulations and politics either, but if a city regulation is unjustified, Simonson should work for its repeal citywide, not try to get a special exemption for the Fairgrounds. If a city regulation is reasonable, it should apply to everyone.

What Simonson wants, really, is what any landlord would love to have: The ability to lure tenants away from other landlords with the promise of tax and regulatory exemptions. That's hardly fair to landlords who can't offer the exemption, especially when everyone depends on the same public services.

Whether or not collecting city sales taxes at the Fairgrounds has been a windfall, Fairgrounds retail sales now contribute their fair share towards the upkeep of the city streets that allow people to reach the Fairgrounds, the upkeep of the city storm sewers that carry stormwater away from the Fairgrounds (a considerable amount since so much of the 230+ acres is impermeable), and the cost of city police and fire protection for the Fairgrounds and environs.

One of the most important benefits of having the Fairgrounds within the city limits is that the planning of its future development will be done in conjunction with planning for the adjoining neighborhoods, guided by the City of Tulsa's comprehensive plan, with the involvement of City of Tulsa planning staff, and with the final say of the Tulsa City Council. I suspect that eliminating this independent oversight of Fairgrounds development is the real aim of Simonson's push for deannexation.

When the Fairgrounds was outside the city limits, there were no checks and balances over land use changes. The TCPFA, made up of the three county commissioners and two people they appoint, would propose a special exception or variance, and the County Board of Adjustment (appointed by the county commissioners) would approve it. Or the TCPFA (three county commissioners plus two people they appoint) would propose a zoning change or comprehensive plan amendment, the TMAPC would make a recommendation, and the county commissioners could vote for the TCPFA's proposal regardless of the TMAPC's recommendation. There was no one looking at proposed changes to land use at the Fairgrounds to mitigate any impact on the surrounding neighborhoods.

This is the heart of the issue: With Drillers Stadium and the old Tulsa City-County Health Department likely to be redeveloped, just across 15th Street from a residential area, City of Tulsa planning staff and City of Tulsa councilors should evaluate any of the TCPFA's redevelopment plans in accordance with the comprehensive plan and the zoning code. Terry Simonson and his former county bosses don't want that, it would seem.

Simonson makes a very misleading statement near the end of his essay:

The state and local economies have improved enough that the city council should do the right thing by giving Expo Square back to the TCPFA.

The city never took Expo Square away from the TCPFA. The Fairgrounds are owned, as they have been for decades, by Tulsa County. Just like the County Courthouse, the David L. Moss Correctional Center, County Election Board, LaFortune Park, the county road barn at 56th and Garnett -- all owned by Tulsa County, but within the Tulsa city limits and governed by the City of Tulsa's ordinances. Other county properties are within the limits of other Tulsa County municipalities -- Haikey Creek Park, for example. Simonson isn't calling for deannexation of those county properties; why should Expo Square be any different?

MORE: Some past BatesLine articles and Urban Tulsa Weekly op-eds about annexation:

November 2006: Annexing the Fairgrounds

Again, it has to be emphasized that annexation wouldn't change ownership. The fairgrounds would still be owned by Tulsa County and run by the Tulsa County Public Facilities Authority (TCPFA, aka the fair board), which consists of the three county commissioners and two other members.... Annexation wouldn't affect the fair board's ability to enter into long-term, non-competitive sweetheart contracts.But annexation would eliminate the anomalies in law enforcement and tax rates. The fairgrounds and the surrounding land would be subject to the same zoning ordinances and zoning process. The same sales tax rate would apply to businesses on and off the fairgrounds. The same hotel/motel tax rate would apply to the fairgrounds motel and to nearby motels. The same noise ordinances would apply on and off the fairgrounds.

When the fair board considers a lease, they'd have to consider whether the proposed activity complies with city ordinances. I'm sure existing uses would be grandfathered in, but any zoning relief needed for whatever replaces Bell's would have to pass muster with the City of Tulsa's Board of Adjustment (which applies the law as it is; one of Bill LaFortune's positive legacies) or the Tulsa City Council. Currently, anything the fair board (made up mostly of the county commissioners) wants to allow only needs approval by the County Board of Adjustment (appointed by the county commissioners) or the county commissioners themselves. There's no independent check on fairgrounds development.

UTW, March 7, 2007: Annexation Fixation

Typically, unincorporated areas are places with very little development and much open space. When your nearest neighbor lives a quarter-mile away, what he does on his property isn't likely to affect your enjoyment of your property. In such a sparsely settled area, you don't need many rules to maintain peace, safety, and quality of life.But in a densely developed area, those rules are essential. As Robert Frost wrote, "Good fences make good neighbors." I spent several years of my childhood in a subdivision in an unincorporated area, and I can attest to the problems created by noise, dogs allowed to run free, lots allowed to grow wild.

To maintain quality of life where homes and businesses are packed closely together, the city regulates land use, noise, lighting, and other potential sources of annoyance that may spill over onto a neighbor's property.

But here in the heart of our city is a huge chunk of land that isn't subject to any of those rules, and without those rules in place, the Tulsa County Public Facilities Authority has not been a considerate neighbor....

The TCPFA has allowed outdoor auto racing (in violation of a 1984 promise) and the annual Chili Bowl indoor races, both of which create noise in excess of city standards. During the 2004 Chili Bowl race, even with the Expo Building's doors closed, noise was measured at 85 dB nearly a half-mile away. You can imagine the impact on homes right across the street.

If Expo Square were within the city limits, the TCPFA would have to provide better noise insulation for the building or require Chili Bowl participants to muffle their cars. Given the economic impact of the Chili Bowl, I'm sure that the city would make reasonable accommodation on that issue, as well as on the issue of city building permits (another concern cited by annexation opponents). What matters is that the city would be in the loop, not helplessly enduring whatever nuisances the county chooses to harbor at the Fairgrounds.

The Chili Bowl continues to thrive and grow, by the way, notwithstanding the jurisdiction of the City of Tulsa.

Many thanks to KJRH Channel 2 (Cox Cable 9) for a well-balanced story on Vision2 today. I spent a couple of hours with Citizens for a Better Vision, the organized opposition group to Vision2, out on 51st Street where people could pick-up signs, buttons, and bumper stickers.

While I was there a KJRH cameraman came out to get some video for a news story that ran this evening, and he talked to me for a few minutes, part of a story on the efforts of the "vote yes" and "vote no" campaigns. The result was a well-balanced and accurate story, and I commend the KJRH news team for their good work: "Vision2 vote nears, both sides step up campaign efforts." I thought they did a good job of picking out quotes that represented the two campaigns.

Michael Bates is a blogger and a staunch opponent of the tax plan."It doesn't make sense for us to commit money that we don't begin collecting for four years and to spend almost $100 million just on interest to carry debt for 17 years," said Bates, who believes much of Vision2 amounts to corporate welfare.

Bates said he believes Vision2 was put on the ballot too quickly.

"The Vision2 plan is too rushed, too soon, and too sloppy the way it was put together," said Bates....

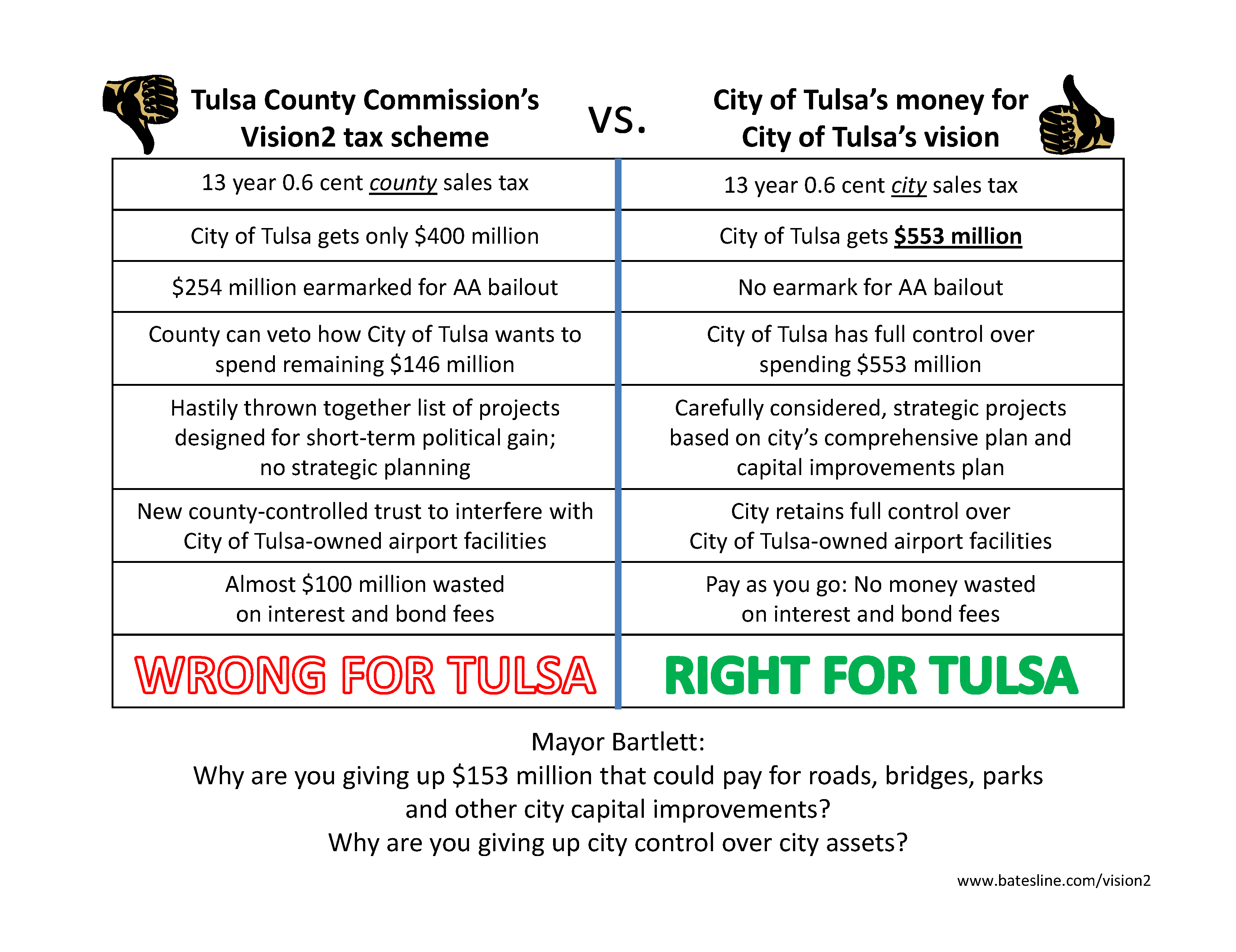

For his part, Bates believes it would be a better idea for cities to pass a six-tenth sales tax to replace the current Vision 2025 tax when it expires. He said the cities would be able to spend the money on whatever projects they think are necessary, without a say from the county.

"The city of Tulsa, for example, would raise $150 million more than we get from the Vision2 program," said Bates.

I made it clear that I wasn't speaking for all opponents of Vision2, and notice that KJRH was careful to qualify that statement with "For his part." They did a good job of summarizing my alternative proposal.

According to county employee Michael Willis, however, no one in the opposition has submitted anything better than his bosses' scheme.

"They've not participated in public input meetings. You have two different kinds of people in that campaign --people who are promoting themselves for individual public office and the people who are always on the 'no' side of just about every issue," said Willis.

Several opponents did go to public input meetings. I spoke at the meeting where the Tulsa City Council voted on how Tulsa's tiny cut of the funds would be allocated. But it's true that opponents did not line up demanding money for our pet causes. We wanted more than a slight rearrangement of the distribution of the $750 million. We disagree with fundamental aspects of the Vision2 county tax scheme that were set in stone before the public meetings were held.

Perhaps, from Willis's perspective, my proposal isn't worth considering because it doesn't include corporate welfare for a bankrupt airline that may well not exist by the time we begin paying back the money we borrowed to bail them out. Maybe he dislikes my plan's lack of an uncapped corporate welfare fund under the guidance of the same folks who gave us Great Plains Airlines. Maybe it's no good because it doesn't let the county's favored bond underwriters, bond attorneys, and program management contractors "wet their beaks." Maybe my idea is lousy because it cuts his bosses, the county commissioners, out of the decision-making process.

The vitriol from the "Vote Yes" side is disappointing, particularly coming from a Republican. You'd hope a Republican would see the inefficiency in passing tax dollars destined to be used by city governments through county government. You'd hope a Republican would have qualms about incurring debt that we'll still be paying off when my 6-year-old son is working on his doctorate.

And of course, Willis is wrong to believe that only opponents of past tax plans are opposed to Vision2. Many supporters of Vision 2025 and the River Tax are among the most vocal opponents of Vision2. For example, see recent Urban Tulsa Weekly columns by Ray Pearcey and Bill Leighty, and the statements of opposition from TulsaNow and former Tulsa Councilor Bill Christiansen, who served on the committee that put together the Vision 2025 package.

Here's a direct link to a one-page PDF that explains my alternative to Vision2 and why it's a better vision for Tulsa. (It's a better vision for Broken Arrow and other cities and towns, too.)

MORE: Tulsa County GOP chairman J. B. Alexander called my attention to this story about the Poway, California, school district which is borrowing $105 million for a total cost of $1 billion, because they don't begin paying on principal or interest for 20 years and won't finish paying it back for 40 years.

The bonds are a "kick the can" move to avoid dinging taxpayers now with higher property taxes.Oh, and the bonds are not callable -- they can't be paid off early or refinanced.

School administrators appear to have looked around at the sluggish economy and property tax revenues and figured, 'Heck, why not defer now and pay nothing at all for decades? We'll be dead by then.'"...

The underwriters for the nearly $1 billion Poway bond deal, Stone & Youngberg, a unit of Stifel Nicolaus, and financial advisor Dolinka Group of Irvine, Calif., will get a sweet $1.4 million in total fees, says FOX News analyst James Farrell.

Citigroup (C), Goldman Sachs (GS), Bank of America/Merrill Lynch (BAC), among others, will split a cool $2.1 million on San Diego's $164 million bond where taxpayers will eventually pay a billion dollars, Farrell notes. ...

In two decades' time, taxpayers in the Poway district will have to start paying about $50 million a year towards the loan -- one-fifth of its current $250 million budget. However, right now, the district only receives about $11 million a year from homeowners towards paying off its bonds.

One estimate says the total assessed value of property within the taxed area would have to quadruple just to cover the eventual $1 billion bill for this one bond alone.

I had been looking at these items in isolation, but I'm beginning to see a pattern emerge. There are several instances with Vision 2025 and with Four to Fix the County Part 2 where the county allocated a small amount of money -- not enough to complete the project, but enough to use the project as a selling point to pass the tax. They're doing the same thing in Vision2. It's bait-and-switch.

American Indian Cultural Center: Vision 2025 included $2 million for this project, which was to be built north of 71st Street along the west bank of the Arkansas River. But according to this 2007 story in Indian Country News, a non-profit group called the National Indian Monument and Institute (NIMI) would have to raise $22 million in private funds to qualify for $2 million in county funds for infrastructure. A further $35 million would be needed for the final phase. It hasn't happened, and it looks like it never will. IRS Form 990 filings for NIMI show only $1,209,279 raised from 2004 to 2010, most of that between 2004 and 2007. NIMI is headed by Monetta Trepp, a Perryman family descendant who owns the Perryman Ranch south of Bixby. Their major annual project seems to be the Tulsa Indian Art Festival, which is listed as DBA on NIMI's 990 forms.

The Vision 2025 county contribution was about 8% of the cost of the first phase, not enough to bootstrap the project toward completion. Had the Tulsa County allocated enough funds to build the facility, they would have had to eliminate or shortchange other vote-getting projects. (The Vision 2025 surplus allocated to complete the BOK Center in high style would have been enough to build the Phase 1 of the AICC and make a good start on Phase 2.)

Tulsa County juvenile justice facility: As documented on BatesLine last week, 4 to Fix the County II included $2,446,625 that was sold to the voters as sufficient to renovate the existing juvenile justice facility and build a four-story addition. But instead of carrying out the promised work, the money was repurposed (six years after the tax was approved by the voters) to buy land on which a more expensive facility would be built. The new facility, with a price tag of $38 million, is on Tulsa County's Vision2 wish list.

Arkansas River low-water dams: Vision 2025 was sold to the public as putting water in the river, with promises that federal money would provide the rest of what was needed to build two new dams and fix the Zink Dam. That never happened. Instead the 2007 Tulsa County river tax was proposed to pay for the dams, and it was claimed (falsely) that Vision 2025 was only intended as seed money. Here's the actual language in the Vision 2025 Proposition 4 ballot resolution:

Construct two low water dams on Arkansas River the locations of which will be determined in the Arkansas River Corridor Plan -- $5.6 millionZink Lake Shoreline Beautification -- $1.8 million

Design and construct Zink Lake Upstream Catch Basin and silt removal -- $2.1 million

Not planning funds, not engineering funds, not seed money -- "construct two low water dams."

This blog entry from 2007 has a timeline of claims made by Tulsa County officials about the dams and the proposal to use surplus Vision 2025 receipts to complete the dams if other funds are unavailable. My July 25, 2007, UTW column specifically rebuts claims made by county officials that the dams were never promised in Vision 2025. As with the other projects mentioned above, surplus Vision 2025 surplus funds likely would have been sufficient to complete this project, but we used $45.5 million of the surplus to pay for a fancier arena, which committed a similar amount for unspecified suburban projects so the 'burbs would go along with extra money for the arena. (Tulsa County Commissioner John Smaligo acknowledged that these commitments had been made in a May 2012 interview with KFAQ's Pat Campbell.)

This pattern continues with the Vision2 plan. The City of Tulsa's allocation includes $5 million toward the completion of the western legof the Gilcrease Expressway and its crossing of the Arkansas River, a project that the Oklahoma Turnpike Authority estimated would cost $857 million to build. The feasibility study itself cost just shy of $1 million. But putting a token amount toward the project allows the Vote Yes people to claim the Gilcrease Expressway on the list of projects and to claim the endorsements and votes of the expressway plan's biggest fans. Although the amount is a drop in the bucket of what will be required to build the project, it seems to have been enough to win Councilor Jack Henderson's support for Vision2.

The only way to break the county of the bait-and-switch habit is to tell them no.

MORE: A post on Yes to Vision2's Facebook page links a video about KRMG's Great Raft Race, a popular Labor Day weekend event in the '70s and '80s, using it to suggest that Vision2 would make such events possible again. ("I think we can all agree that making some river improvements would help support recreation events!") I replied with a comment that the construction of Zink Dam was the beginning of the end of the Great Raft Race. You need flowing water, not dammed-up water, to have a raft race. The offloading point had been on the east side of the river, just south of the pedestrian bridge, an area now below the dam. The race adjusted after the dam was completed, but it never worked as well after the dam was built, and within a few years they stopped entirely.